A-star is born: ASTR to power Sony's new L2

TON and Base proved distribution is king; Soneium now poised to take the throne

Disclaimer: M31 Capital may hold positions in tokens mentioned below

Astar Network, a smart contract platform originally deployed as a Parachain and zkEVM, is evolving into Soneium, an Ethereum L2 leveraging the OP stack. Spearheaded by Sony Block Solutions Labs, a collaboration between Sony Group and Startale (the team behind Astar), Soneium aims to finally take Web3 technology mainstream, in large part by unlocking new monetization opportunities for Sony’s prodigious intellectual property (IP) portfolio. Astar’s native token, ASTR, will rebrand to become the core asset within the Soneium ecosystem

Sony’s Web3 Vision: Expanding IP Monetization

Sony has been very open about its goal of enhancing content value creation by leveraging new and innovative technologies. The company’s embrace of Web3 technology specifically, which began in April 2022 with the launch of its internal blockchain business unit, signals a strategic pivot aimed at revitalizing its IP monetization performance, which has fallen behind competitors like Disney in recent years. Sony, though less visible in the Web3 space compared to companies like Coinbase and Telegram, holds a unique advantage: an enormous IP portfolio and a massive, highly engaged user base spanning gaming, music, movies, TV shows, hardware devices, and financial services.

Soneium Chain: Years in the Making

Sony, based in Japan, decided to enter the Web3 space several years ago. Instead of building its capabilities internally, it decided to partner with the leading Japanese blockchain ecosystem, Startale Labs (the team behind Astar Network). Their relationship began almost two years ago, when the two entities launched a joint Web3 incubation program to explore “how blockchain technology can solve various problems in [Sony’s] industry." A few months later, Sony invested $3.5m directly into Startale, to further solidify their Web3 partnership. Startale’s CEO, Sota Watanabe, was appointed Director of Sony Block Solutions Labs, commenting:

“With its wealth of IP and expertise in sectors adjacent to the creator economy, Sony Group has tremendous potential in the Web3 space, and we can’t wait to collaborate on tapping into that.”

Most recently in August 2024, the joint venture announced their plans to merge and integrate the Astar ecosystem into Soneium, a new Ethereum L2 that will largely focus on monetizing Sony’s broad portfolio of IP assets. In the press release, Sony Block Solutions Labs Chairman, Jun Watanabe, explained the company’s strategic Web3 vision:

“We think the development of a comprehensive Web3 solution based on blockchain technology is very significant for Sony Group, which has developed a wide variety of businesses as part of its purpose to "Fill the world with emotion, through the power of creativity and technology". We will work to create diverse businesses and new use cases with the aim of delivering customer value that can only be enjoyed through Web3 technology to as many users as possible and making people's lives richer and more colorful.”

ASTR Investment Thesis

It's important to consider the parallels between Sony's venture and the success of Base and TON blockchain. Base is currently handling 40% of all Layer 2 transactions, despite launching much later than other Layer 2 solutions such as Optimism, Arbitrum, Linea, and Mantle. The investment thesis for TON, which reached a $40+ billion FDV earlier this year, is largely based on Telegram's massive user base and high engagement rates. This highlights the profound significance of distribution in growing Web3 ecosystems. Although Sony has kept its blockchain aspirations closer to its chest, Web3 has quietly become a top initiative internally to enhance IP monetization. This directive has come directly from Sony’s CEO, Kenichiro Yoshida, and has the support of the Board of Directors. Sony even recently acquired the crypto exchange Amber Japan earlier this year, rebranding it to S.BLOX, and is also developing its own wallet infrastructure. Furthermore, recent patents filed by Sony illustrate their strong desire to integrate Web3 into its existing IP:

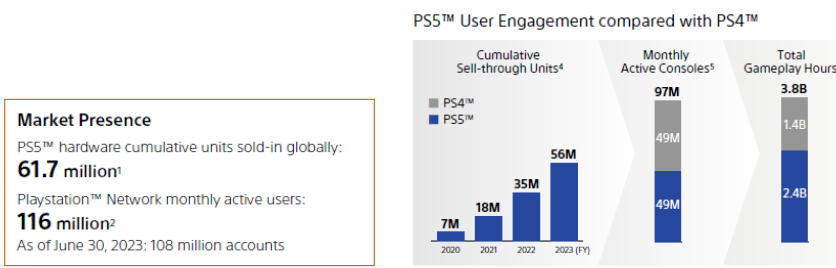

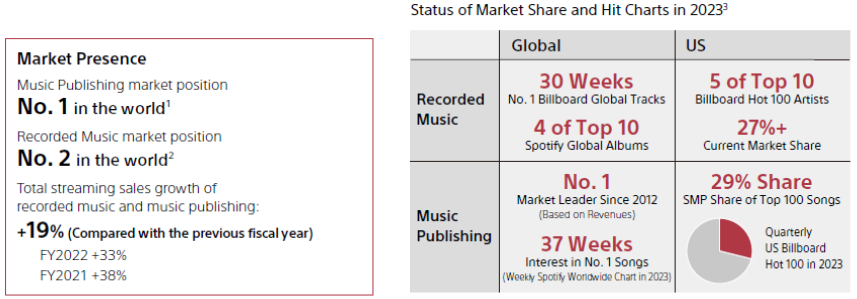

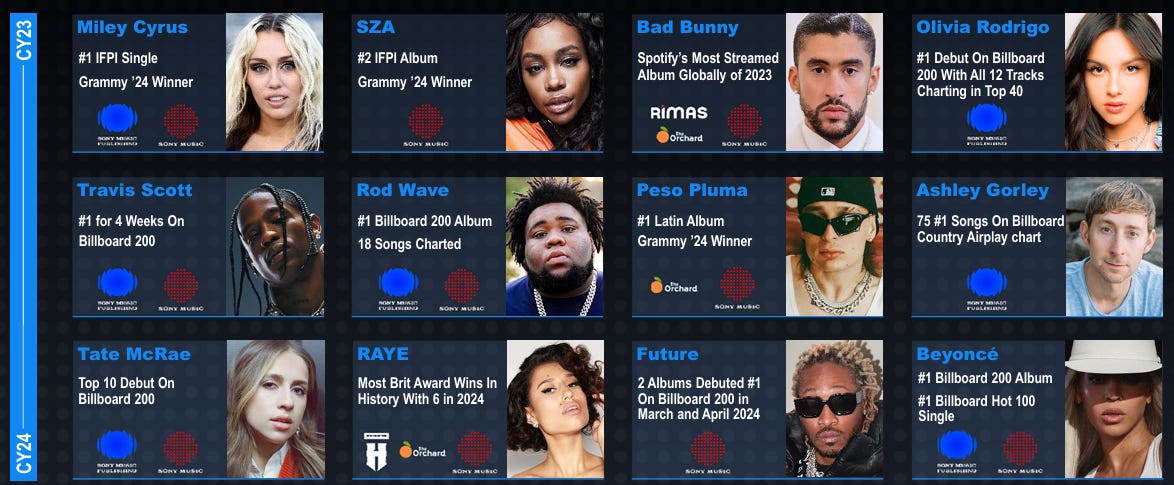

Sony, with its wide array of products and services, generates significantly more revenue with stronger user distribution than both Coinbase and Telegram. This user base spans multiple sectors—gaming (PlayStation Network has 116m MAUs), music (global leader in published music and #2 in recorded music), movies (>4k titles), and TV shows (>400 titles), as well as hardware devices (smart phones, TVs, cameras, image sensors) and financial services ($50b in life insurance policies)—offering Soneiumn unprecedented Web3 monetization opportunities.

Given the complicated structure of the Sony/Startale partnership, ASTR’s value accrual in the Soneium economy is not well known or understood by the market. This has created a highly attractive entry valuation, which we expect to re-rate significantly as Astar and Soneium continue to execute and market their plans more broadly. TON’s all-time-high FDV of $40b, as well as our expectation for Sony IP & user base monetization (more details in valuation section), suggest ASTR has a long-term upside potential of 80x+.

Sony’s Web3 Monetization Potential

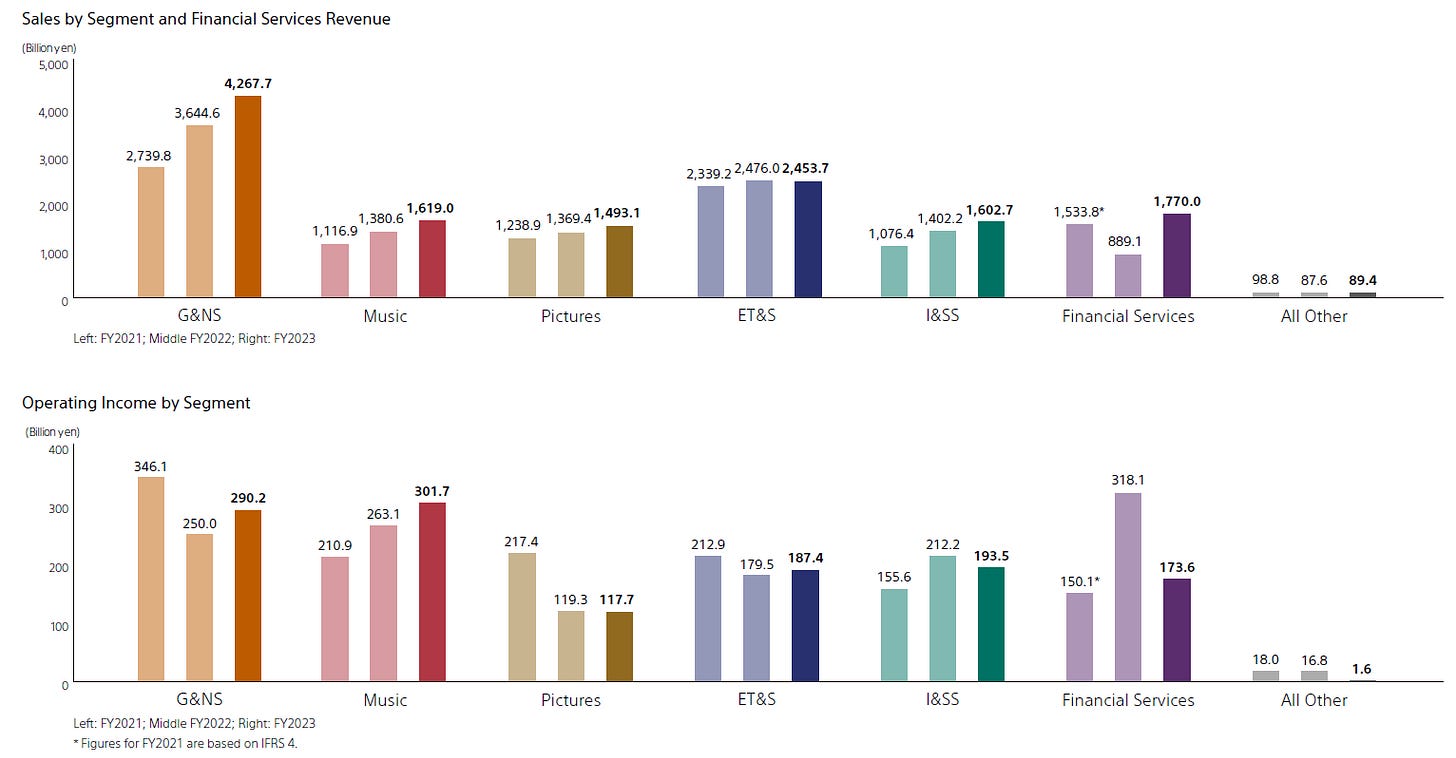

Sony is a Japanese conglomerate organized into the following business segments: Game & Network Services (G&NS); Music; Pictures; Entertainment, Technology, & Services (ET&S); Imaging & Sensing Solutions (I&SS); and Financial Services.

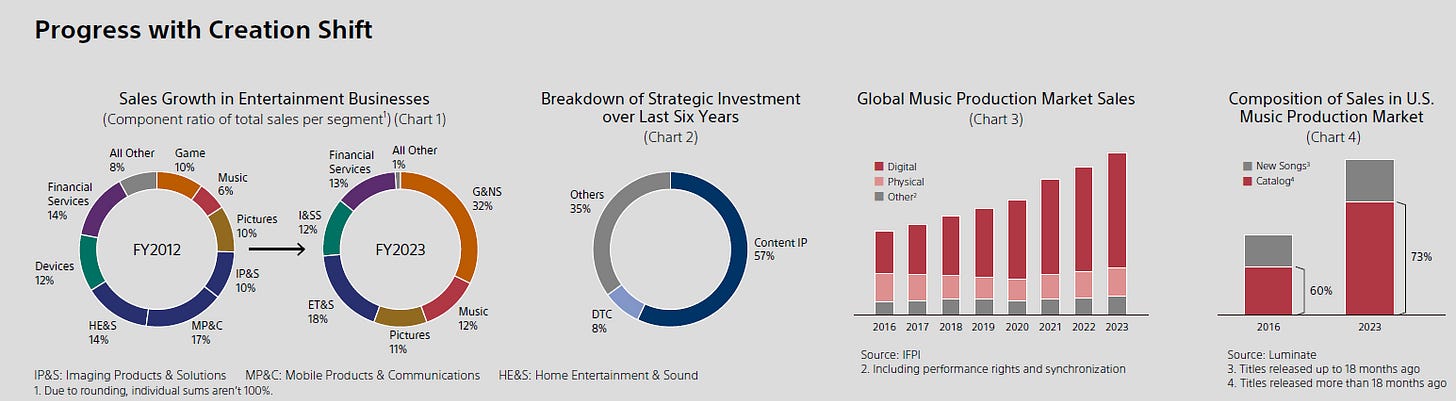

Evolution from Content Distribution to Content Creation

Over the past decade, the company has had to adapt to changing market dynamics, shifting its focus from content distribution (hardware) to content creation & ownership (gaming, music, movies, and TV IP). In Sony’s latest Annual Report, COO & CFO Hiroki Totoki explained:

“Looking at the external environment, the entertainment market is clearly growing with the spread of streaming services and the like, and particularly the global music market has been growing (chart 3 below). Within that trend the value of content IP is rising. While Sony previously focused on the distribution side of business, delivering Kando through sales of hardware and packaged media, today it has shifted its focus to the creative side of Kando.”

Long-Term Vision & Web3 Alignment

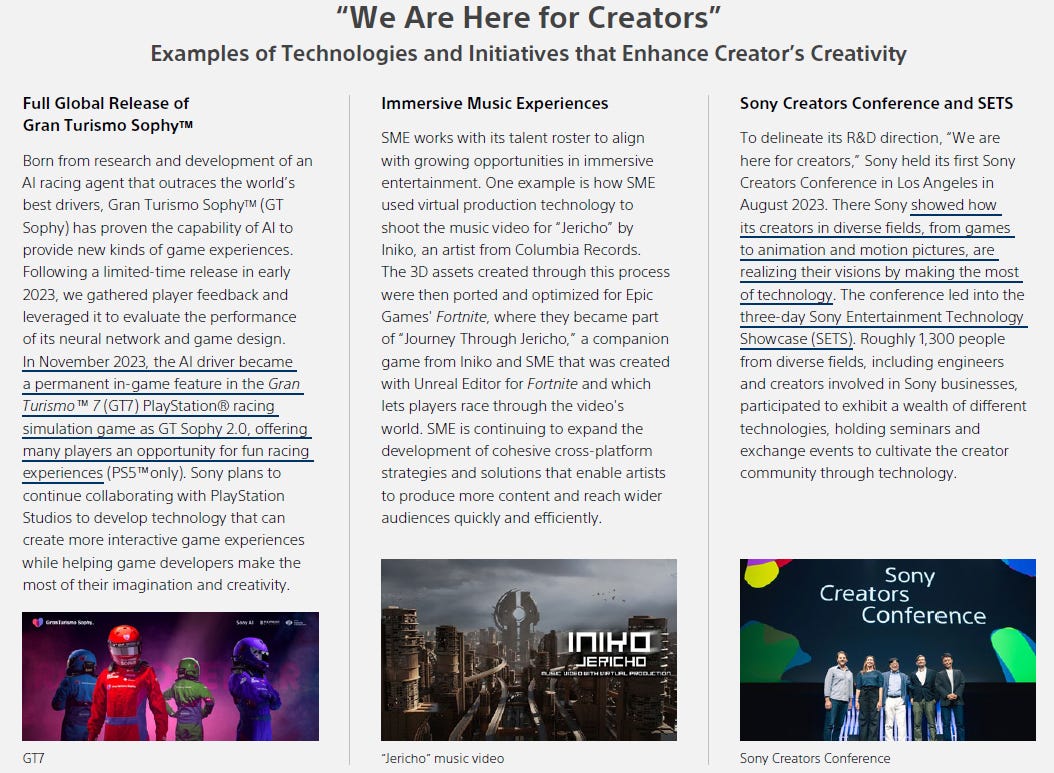

Sony’s stated 10-year vision is to “create infinite realities," integrating physical and virtual worlds, fostering limitless emotional experiences through the fusion of creativity and technology alongside creators. The vision is encapsulated in three key themes: Creativity Unleashed, Boundaries Transcended, and Narratives Everywhere. These signify Sony's intent to use technology to empower creators globally, transcend physical, virtual, and temporal boundaries, connect people across diverse communities, and collaborate with creators to craft imaginative, narrative-rich experiences that inspire and spread globally as new touchpoints for emotional engagement.

Although neither blockchain nor Web3 are specifically mentioned in the annual report, this 10-year vision seems to perfectly align with the technical properties of blockchain and the ethos of Web3. Sony’s future IP monetization initiatives will rely heavily on blockchain, potentially making Soneium one of the largest Web3 ecosystems.

Monetizing Sony’s IP in Web3

Sony’s vast portfolio of content IP in gaming, music, movies, and TV shows presents immense potential for Web3-based monetization. The company has already laid the groundwork for leveraging blockchain technologies in IP protection, digital rights management, and serverless gaming through zero-knowledge proofs. Soneium will capitalize on this IP by integrating blockchain into Sony’s existing ecosystems.

Web3 has mostly failed to break into mainstream adoption with crypto-native games, music, video, and other creator content. We believe Sony has a much better chance of success because of backwards integration: plugging Web3 functionality into already established and valuable IP. Leveraging the Sony ecosystem, Soneium is uniquely positioned to meaningfully experiment, innovate, and disrupt content distribution.

Business Segments:

Gaming & Network Services (G&NS): Develops, manufactures, and distributes gaming consoles, software, and related services, including PlayStation Network and subscription services like PlayStation Plus, generating $30b in revenue last year.

Despite being one of the hottest narratives, Web3 gaming has yet to meaningfully take off, a result of subpar gameplay experiences. Conversely, backwards integrating Web3 functionality into established popular game franchises have a much higher chance of success.

Music: Handles the recording, production, and distribution of music worldwide, including music publishing (#1 globally), recorded music (#2 globally), and visual media & platform operations.

Sony plans to leverage blockchain to create decentralized platforms where creators can release content and protect their IP rights more effectively and directly monetize their work.

Given the established popularity and sheer scale of Sony's music library, we believe backward integrating Web3 functionality will have more success than the previous generation of music-NFT projects.

Pictures: Responsible for motion picture production, TV programming, and media networks. Its content spans feature films (>4k titles), TV shows (>400 titles), and digital content production, making it the only major independent Hollywood studio.

As with music, video creators will be able to leverage Web3 technology to protect their IP rights more effectively and directly monetize their work.

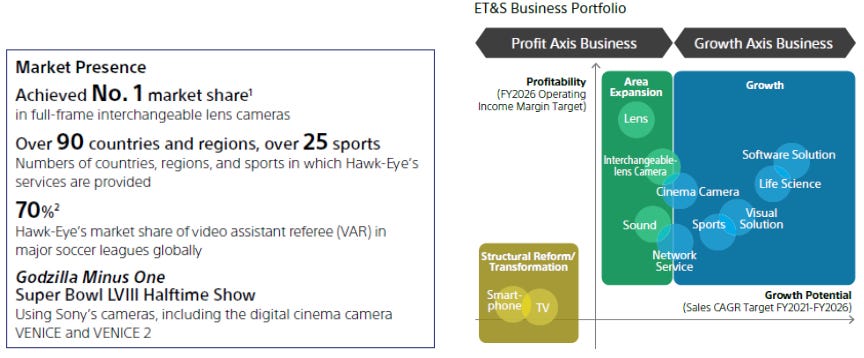

Entertainment, Technology, & Services (ET&S): Focuses on consumer electronics and related services, including the development and production of a wide array of devices such as TVs, cameras, audio equipment, fitness trackers, and smartphones.

The consumer device portfolio could be leveraged as a key distribution channel to onboard users into Web3, either through direct airdrops/promotions, or to bootstrap various DePIN projects.

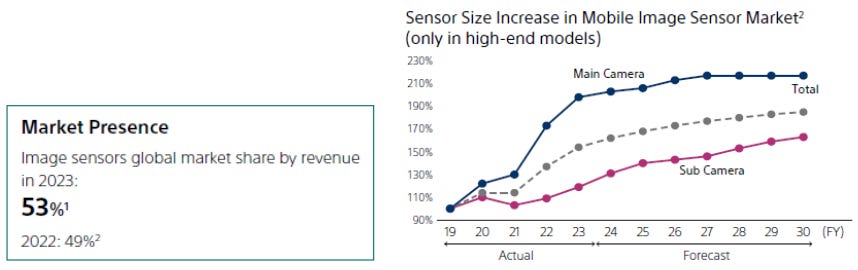

Imaging & Sensing Solutions (I&SS): Focuses on the development and production of image sensors and camera modules, which are integral to a wide range of products like smartphones, cameras, medical devices, and automobiles. Sony is a global leader in CMOS sensors, driving innovations in AI-enhanced imaging, robotics, and automotive sensing technologies for emerging sectors like autonomous vehicles and smart devices.

Given the broad reach and mission critical nature of these components, Soneium could establish DePIN partnerships with top original equipment manufacturers (OEMs) across the globe.

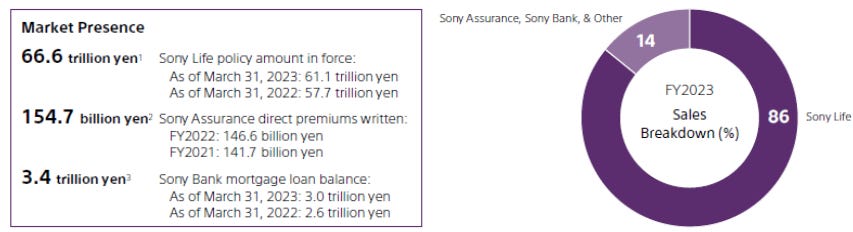

Financial Services: Oversees insurance (life and non-life), banking, and other financial services in Japan. The segment aims to provide innovative and customer-centric financial solutions through life insurance, property insurance, and banking services.

With $55b+ in insurance policies, Soneium has the opportunity to integrate DeFi functionality into these products, offering customers differentiated and novel functionality at lower prices.

ASTR Utility & Value Accrual

Due to potential legal issues, Soneium won’t launch a native token, instead using ETH as the chain’s gas token. However, Sony understands the importance of offering the market an investable asset to help bootstrap the ecosystem flywheel, so they are committed to ensuring economic activity on Soneium directly accrues value to ASTR (Astar’s native token).

ASTR will have four primary functions on Soneium:

Core ecosystem token: ASTR is set to become Soneium’s core ecosystem token to encourage deep collaboration between builders, users, and the wider community. Although not confirmed by the team, we speculate the token will facilitate future revenue share opportunities and/or airdrops for holders.

DeFi Routing Asset: ASTR will function as the primary liquidity asset for DeFi applications on Soneium, helping bootstrap liquidity for new projects.

Payments: Applications on Soneium will be economically incentivized to integrate ASTR, or stablecoins backed by ASTR, into their payment systems.

Staking and Security: ASTR will be staked to secure critical infrastructure such as bridges and oracles within the Soneium ecosystem.

Note: Token utility has yet to be finalized and will likely evolve over time. However, given the aligned motivation to drive ASTR’s value, we have confidence the token will become a direct proxy of Soneium’s future economic activity.

Competitive Landscape

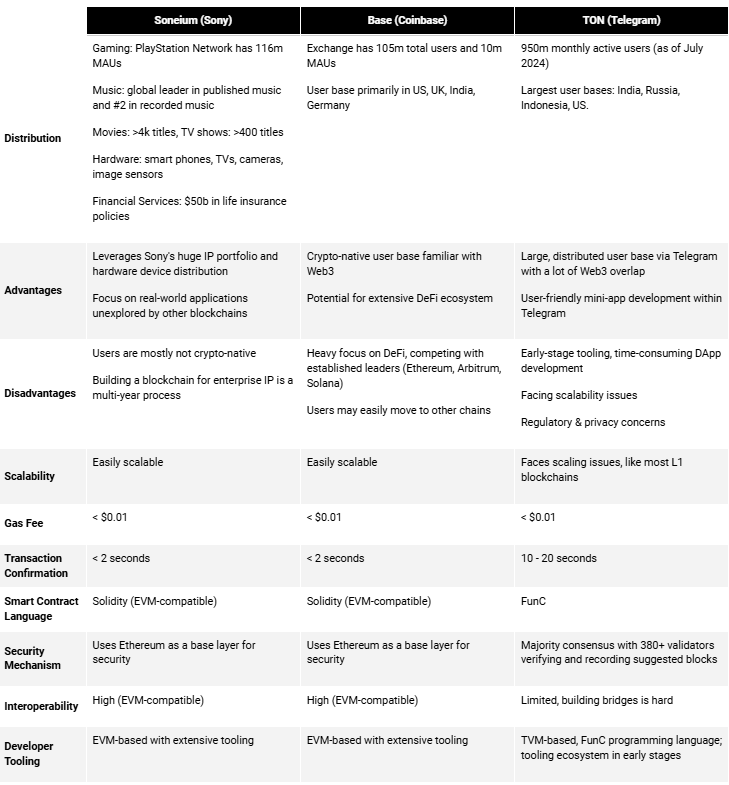

Though Soneium is a general-purpose blockchain, its integration with Sony’s vast IP assets differentiates it from most Layer-2 platforms. Base and TON are the closest “competitors”, but neither have the extensive IP assets and distribution channels that Sony offers.

Valuation and Upside Potential

Comparable Assets

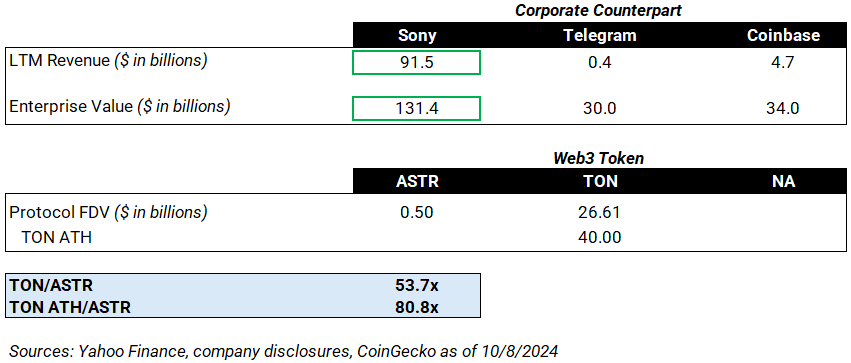

As mentioned above, we believe the most relevant comps for Soneium (ASTR) are Toncoin (TON) and Base (no token), given their similarly close associations with established ecosystems. As illustrated below, Sony’s scale is significantly larger than Telegram and Coinbase, dwarfing both in LTM revenue and valuation. If the market were to perceive a similar upside potential for ASTR as it does for TON, the token could re-rate 81x (vs TON’s ATH). If the market factors in Sony’s superior scale, ASTR’s upside FDV could be multiples higher.

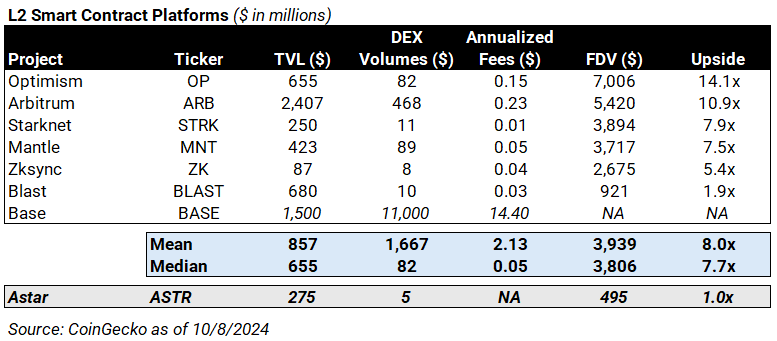

A more conservative analysis compares ASTR to other general-purpose L2 platforms, which have higher valuations given their superior adoption metrics. If Soneium can achieve similar economic activity to peers, it could re-rate 8.0x near-term.

Long-Term Upside Potential

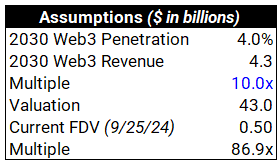

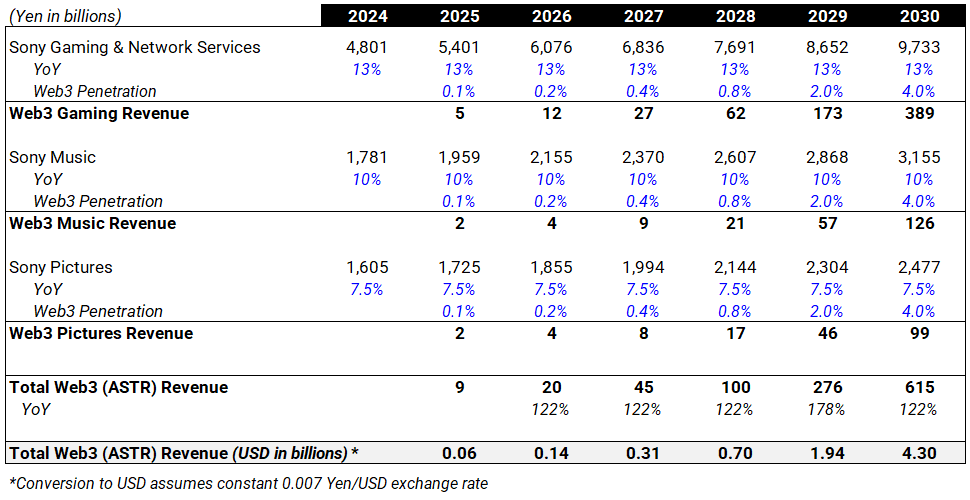

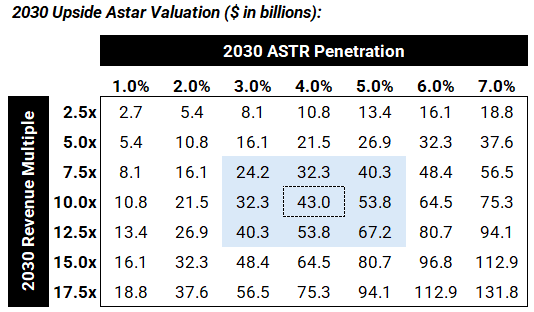

Our long-term upside projections assume Soneium successfully leverages Sony’s Web3-relevant business segments (gaming, music, pictures) to offer differentiated and novel functionality via blockchain technology. To quantify this value, we project each business segment’s revenue through 2030 and assume Soneium “penetrates” (earns incremental revenue from Web3) 4% of each by 2030.

We believe Soneium’s revenue (economic activity) is ASTR’s most practical valuation proxy, yielding an FDV of $43B (similar to TON’s ATH earlier this year) by applying a 10x multiple on 2030 revenue. This implies a ~87x long-term upside potential vs today’s valuation.

Note: Although we conservatively do not include Sony’s hardware businesses or financial services in this forecast, we do think Soneium can leverage both to directly onboard end-users to Web3.

Financial Projections:

Sensitivity Tables:

State of the Chain

Testnet Traction:

Despite being launched less than a month ago, the Soneium Minato Testnet has already shown impressive traction in the market:

Managing more than 100,000 transactions daily

Attracting over 150,000 wallet addresses

These statistics are comparable to networks like Mode, Zora, Starknet, and Polygon zkEVM, which have been operational for a year. It is important to note that Minato is a testnet and not a mainnet; however, this early traction demonstrates the market’s significant interest in Soneium’s potential.

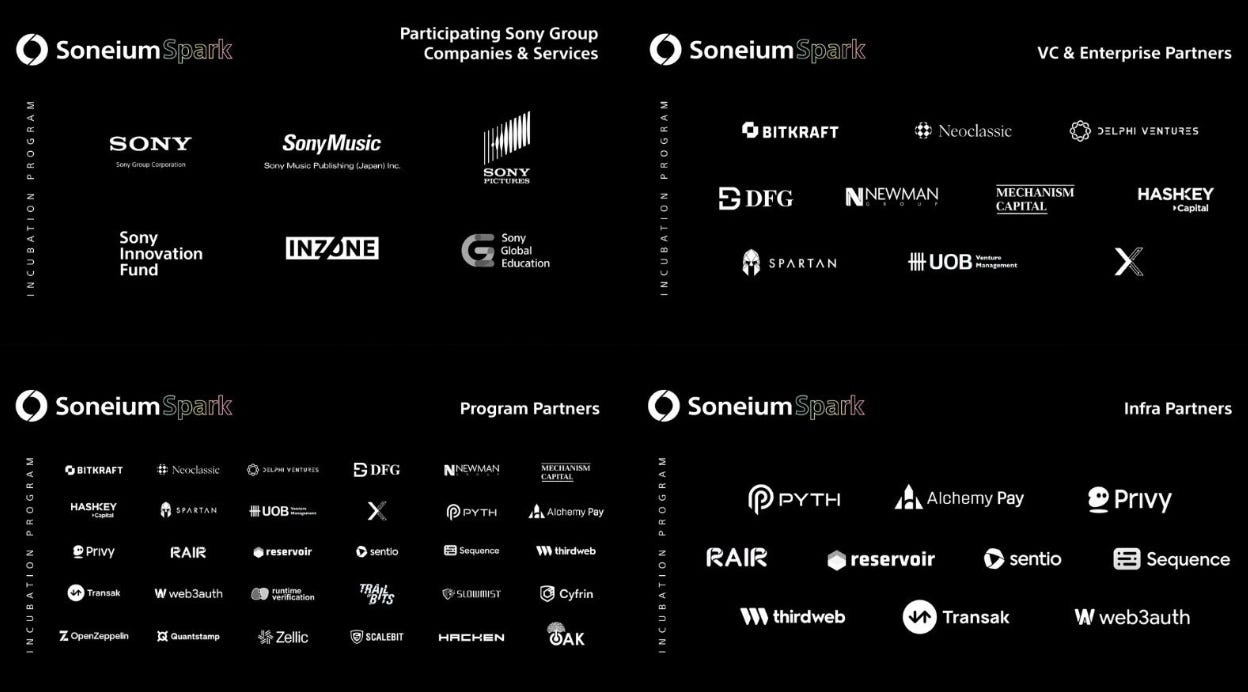

Soneium has also secured partnerships with leading Web3 companies, including Circle, Chainlink, Alchemy, and The Graph, which will provide the essential infrastructure and services developers need.

Soneium Spark Incubator Program

Soneium Spark is a builder-focused incubation program designed to help founders transform their ideas into market-ready solutions.

The program offers:

Expert mentorship

Business support (potential Sony IP collaborations)

Technical support

Strategic partnerships with industry leaders

Investments of up to $100K per team for projects ready to build on Soneium

This comprehensive support system will help accelerate ecosystem development, foster innovation, and expedite network growth. As Sota Watanabe explains:

“Soneium becomes stronger by partnering with builders. Through Soneium Spark, we bridge Web3 and Web2, startups and enterprises, and innovative builders and the mass users. By leveraging Sony Group’s assets and Startale’s experience, we will go mainstream together with the community. We are excited to see creative use cases we will build worldwide together with builders.”

Upcoming Program Milestones:

October 14th: The winners will be officially announced.

October 15th: Winners will begin working closely with the Soneium team to craft personalized support packages and explore all the benefits available to them.

October 30th: The first Soneium Spark Demo Day.

November 15th: The second Soneium Spark Demo Day.

Key Risks

While ASTR’s potential is enormous, there are several key risks to consider:

Nuanced ASTR value accrual: ASTR’s long-term role and value accrual in the Soneium ecosystem is unique and still tentative, which may be a harder story for the market to get behind.

Mitigant: Soneium (Sony) is committed to accruing meaningful ecosystem value to ASTR in order to bootstrap the economic flywheel.

Execution risk: Soneium’s goal of monetizing Sony’s world-class IP onchain is unprecedented and mainstream Web3 PMF has yet to be proven.

Mitigant: This is true of any Web3 initiative that targets mass adoption, but we believe investors are sufficiently compensated for this risk given the token’s relatively low valuation today.

Imperfect parallels to TON/Telegram and Base/Coinbase: These comparisons aren’t perfect considering both Telegram and Coinbase offered crypto-native and crypto-adjacent users. Sony will face a cold-start problem because its user base, while much larger than Coinbase or Telegram, has less crypto exposure and may be more difficult to monetize in Web3.

Mitigant: Soneium is differentiated by Sony’s sheer relative scale and massive IP portfolio and has the strong backing from Sony’s top leadership.

A-star is Born

Astar’s transition into Soneium represents a bold new chapter for both ASTR and Sony. With Sony’s strategic commitment to blockchain and the unparalleled distribution power of its IP portfolio, Soneium is well-positioned to become a dominant player in Web3. For investors, the market’s misunderstanding of ASTR presents a unique opportunity to capture outsized returns as Sony’s Web3 strategy unfolds more publicly.