Whenever I discuss ATOM with the investment community, I typically receive the same pushback: “it’s an L0 not an L1” and “there’s no value accrual to the token.”

While both are (mostly) true today, I believe its unique network design and tokenomics are features – not bugs.

This post is not meant to be a deep dive into the Cosmos ecosystem or its technical design, but rather an explanation of what I think the market is missing when assessing ATOM’s value.

Brief Cosmos overview

Cosmos is not a blockchain, but a network of sovereign blockchains (app-chains or zones) connected by the IBC (Inter-Blockchain Communication) protocol. Instead of sharing blockspace with other dApps (like most blockchains), developers can customize and deploy their own app-chain on Cosmos, which gives them more design flexibility (different applications have different performance/functionality requirements), better scalability / less blockspace competition, and maybe most importantly, a native gas token for dApps to accrue value with.

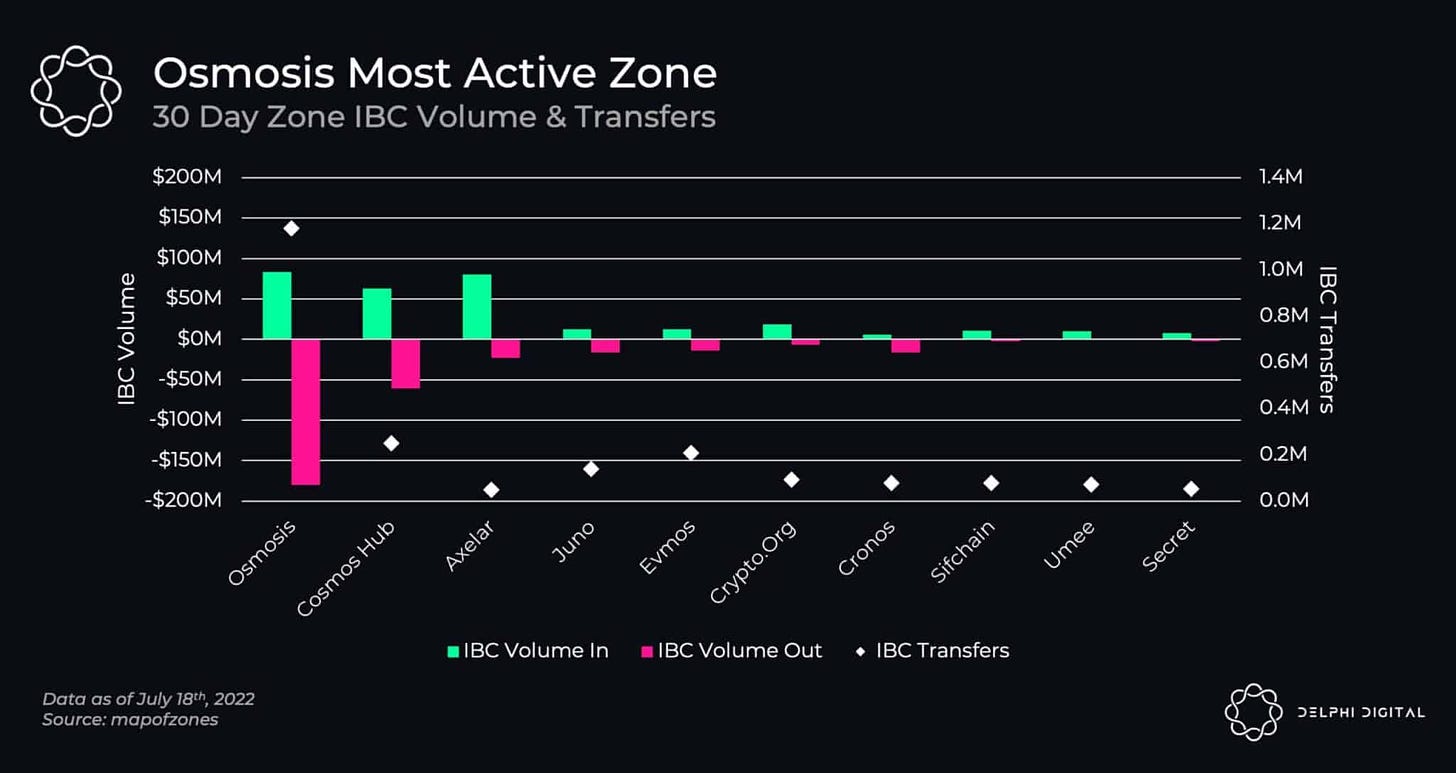

(mapofzones.com)

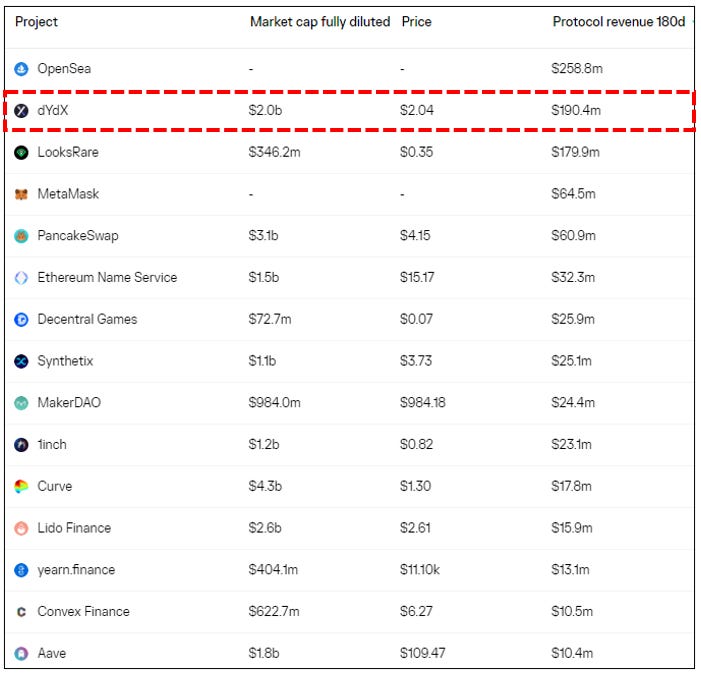

The unique network design has attracted 48 zones since launching the IBC last year, and notably just recruited a top revenue-generating dApp on Ethereum (dYdX) to build its own app-chain. High-profile dApp migrations are expected to continue in the future.

https://cointelegraph.com/news/dydx-moves-to-cosmos-based-blockchain-for-v4-to-optimize-decentralization-and-trading-flow

(top dApp revenue on Token Terminal last 180 days as of 8/16/22)

Cosmos Hub & ATOM token

ATOM is the native token of the Cosmos Hub, the first blockchain launched on Cosmos. For the last few years, the Interchain Foundation has mostly focused on developing the Cosmos SDK, or software development kit, which enables developers to customize and launch app-chains quickly & easily. This move was highly strategic: focus on dApp/developer recruitment first to grow network effects, then add more functionality to the Hub & its native ATOM token.

I’ve previously argued L1 gas tokens derived their value from the demand to participate in the blockchain’s ecosystem (article). But If Cosmos app-chains have their own gas tokens, why do you need ATOM? What does the token even do?

App-chains offer developers many technical advantages over other platforms, but aren’t very useful unless they’re all composable with each other. The Cosmos Hub is meant to be the central “connector” of all app-chains. The blockchain’s functionality is simple by design to minimize tech risk and optimize security. ATOM is the Hub’s native gas token, and can also be used for staking (for inflation rewards & share of Hub transaction fees) or voting on network governance. Therefore, ATOM’s value is derived from the demand to use the Cosmos Hub, the “connector” of app-chains.

App-chain competition killing the Hub?

The first iteration of the IBC enabled cross-zone token swaps (a basic first step to app-chain interoperability), which the Hub supported through its Gravity DEX. However, the developer team ultimately decided to spin off into their own app-chain (now called Crescent Network) because they wanted more technical capabilities than the minimalist Hub could support. Meanwhile, independent app-chain Osmosis has taken the bulk of market share as the ecosystem’s liquidity provider for token swaps.

The Hub is developing a new Gravity DEX (ideal for token swaps that require optimal security), but today is primarily just used for staking and governance, generating only half the transaction volume of Osmosis. On the surface ATOM’s value seems limited – however, I believe most are missing the forest for the trees.

What the market is getting wrong

The market is fixated on the fact that ATOM is not needed to use dApps in the ecosystem like most other smart contract platforms. While true today, this misses the larger Cosmos vision of a highly interconnected network of sovereign blockchains. Beyond token swaps, Cosmos requires deeper interoperability and composability, and given the Hub’s minimalist design (optimized for security), it is best positioned to become the interface that connects the entire ecosystem. How does it get there though?

Interchain Accounts, Interchain Security & the broader Hub vision

Cosmos recently completed several important software upgrades, with focus finally shifting back to the Hub’s functionality and ATOM’s value accrual. I believe the recent introductions of Interchain Accounts (IA) and Interchain Security (IS) are profoundly significant for ATOM, and will solidify the Hub as the central interface of the entire Cosmos ecosystem.

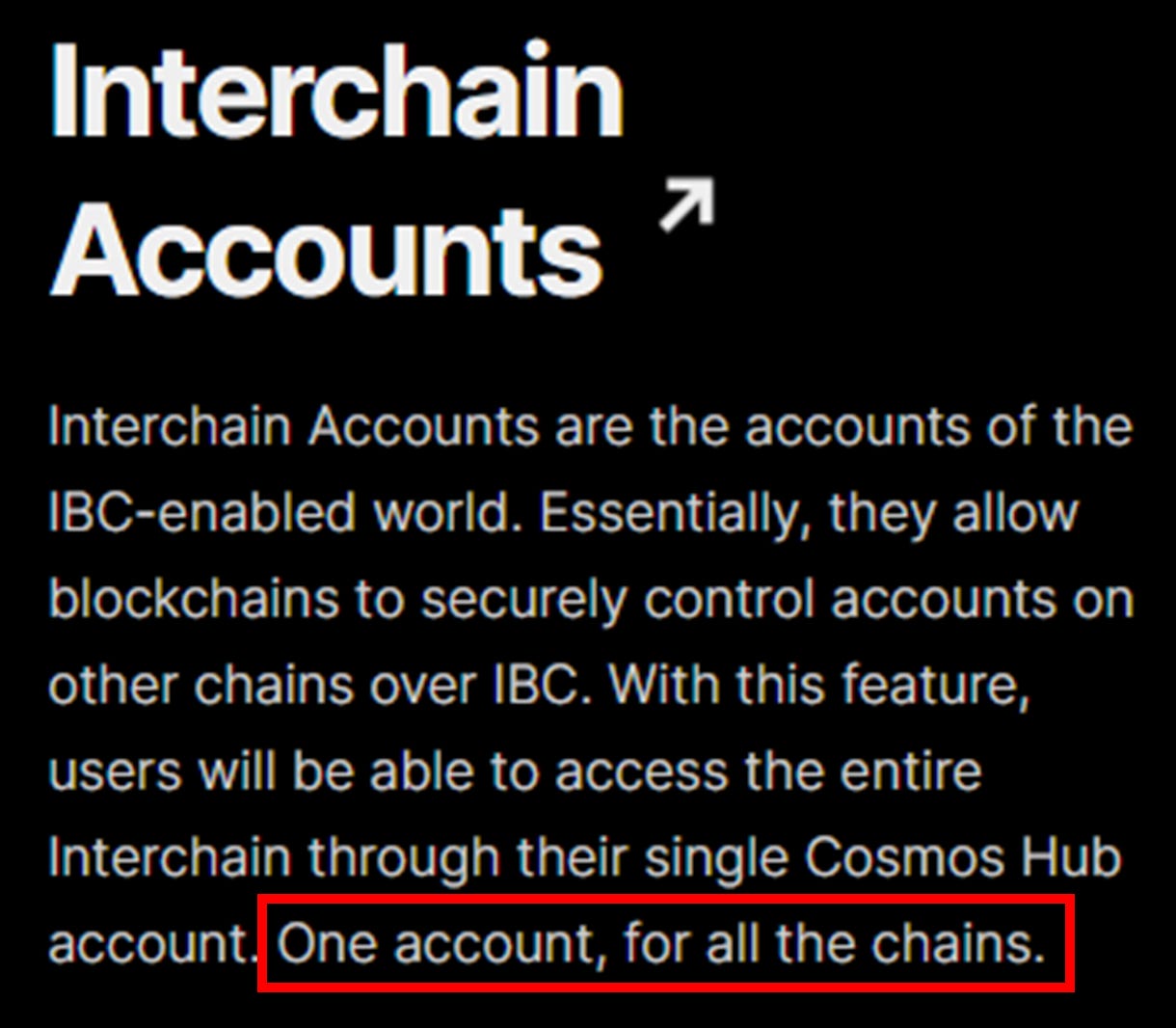

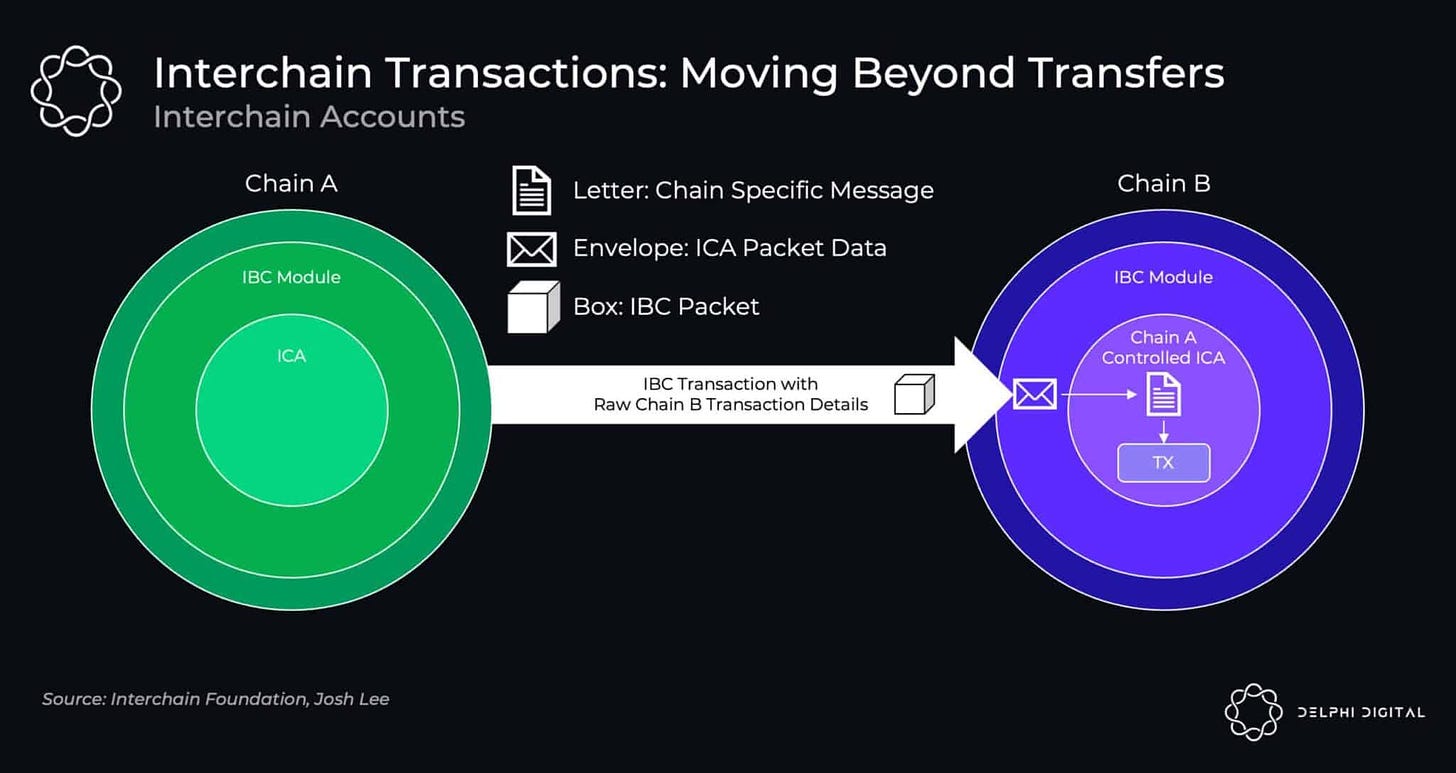

Interchain Accounts — Beyond simple cross-zone token swaps, this new module allows a user account in one zone to control its account in another zone (or many zones). This cross-chain compute composability will enable exciting new use-cases not possible on other blockchains. Given its structurally superior security, the Hub aims to become the central user-interface to connect and control accounts on all other zones. If all zone activity starts with the Hub, demand (and value) for ATOM will explode.

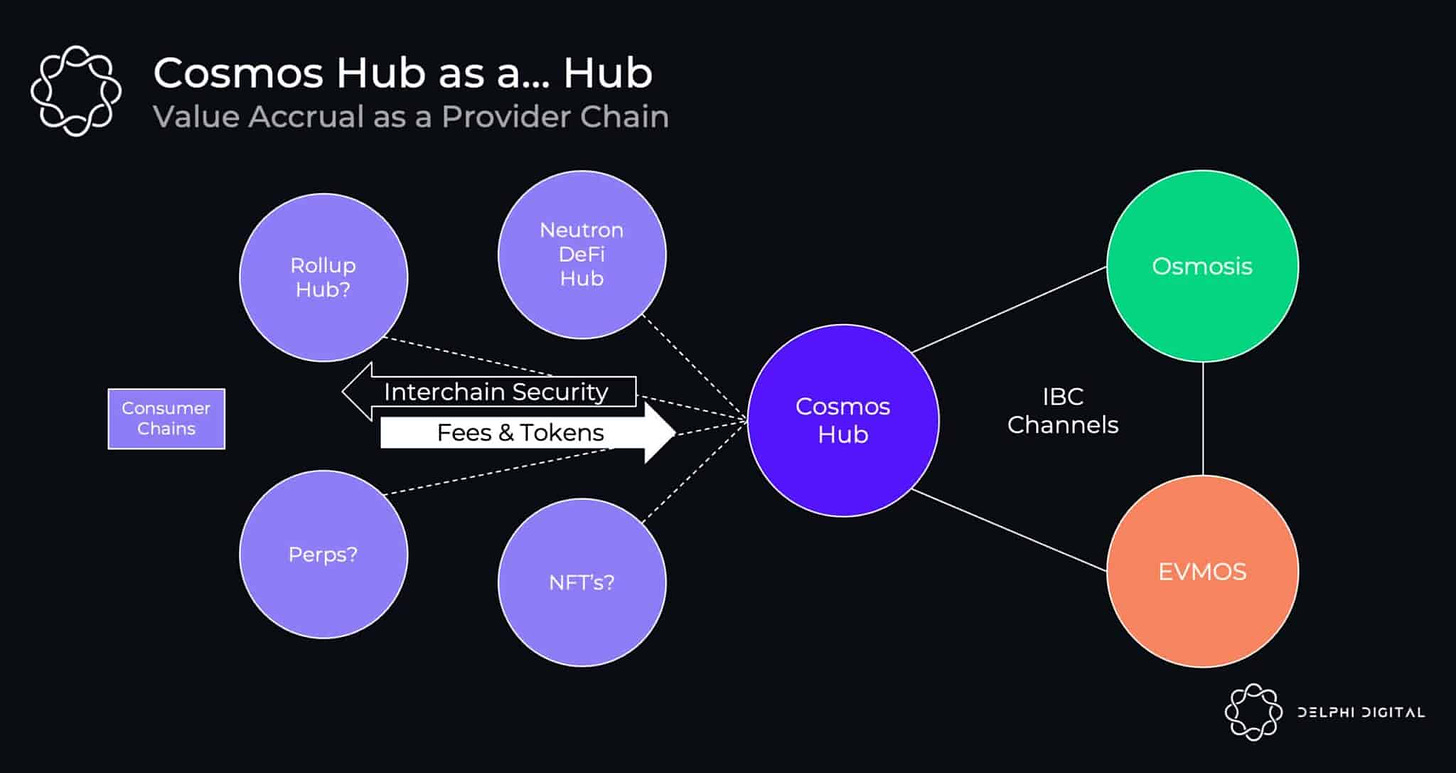

Interchain Security – Staked ATOM will soon be able to secure other app-chains as well, receiving their native gas tokens as compensation. So, although you may not need ATOM gas to use app-chains directly, stakers will be able to participate in the ecosystem’s upside by “taxing” zones that leverage security from the Hub.

Other modules that should also increase Hub activity and ATOM demand include:

(new project currently in beta)

TL;DR

I believe the Hub will become the main interface for the entire Cosmos ecosystem; the more functionality & activity on the Hub, the more demand & value for the ATOM token. In the near/medium term, IA and IS will be the largest drivers of Hub adoption and ATOM utility.

What’s the opportunity?

Cosmos has proven that it can successfully compete with Ethereum. Back of the envelope math: Ethereum’s ATH market cap last year was $600B; if Cosmos continues to execute on its long-term vision there’s no reason ATOM couldn’t attain at least half of that over the next 3-5 years (~100x).

Disclosure: we have a position in ATOM