Exploring value accrual across the modular blockchain stack

economic implications of the rapidly evolving competitive landscape

Disclosure: Omnichain Capital may hold positions in tokens mentioned below.

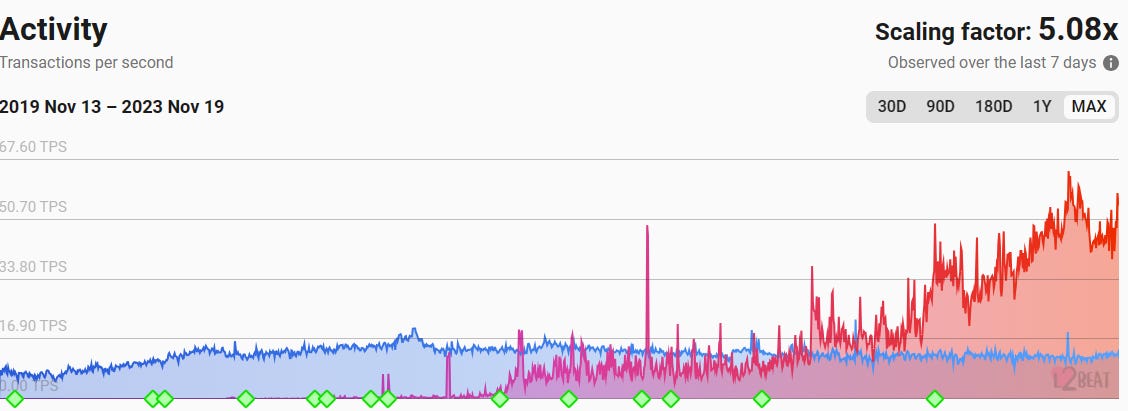

Last year I published “Destined for Obsolescence?”, which laid out my thesis on modular blockchain architectures. By isolating and iterating on specific pieces of the tech stack, blockchain ecosystems can become more resource efficient & less vulnerable to obsolescence risk. The vision has progressed significantly in the months since, with the proliferation of Ethereum L2s now in mainnet (illustrated in red below, executing 5-6x more transactions than the base layer in blue) and recent launch of Celestia, the first modular-specific blockchain.

With the public launch of many of these tokens (e.g. $TIA for DA & consensus, $OP/$ARB for execution, etc.), the topic of value accrual has become top of mind. L1 tokens have long been considered the best way for investors to gain exposure to particular ecosystems; but in a modular future, does this theory still hold? Are some layers more valuable than others?

Modular blockchain refresher

Modular blockchains refer to a layered approach to L1 architecture, where blockchain components are decoupled and optimized for specific tasks. The logic is similar to traditional business process outsourcing, which deliver operational efficiencies and cost savings, while enabling companies to focus solely on their core competencies.

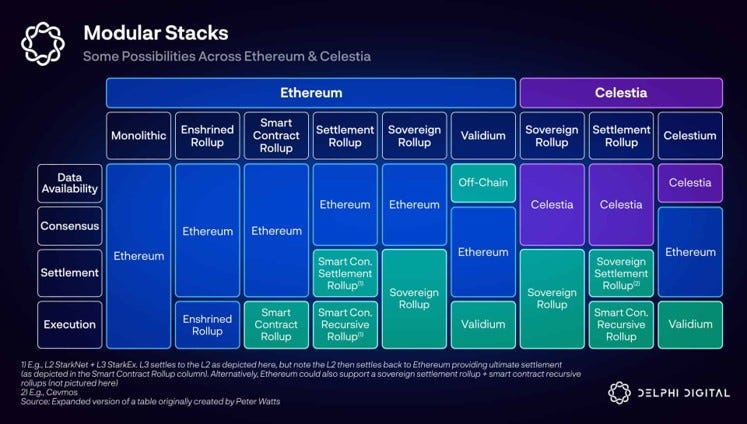

There are many different flavors and configurations of modular blockchains today, and the technology (and terminology) is continuously evolving. For the sake of simplicity, blockchain functionality is typically broken down into four main segments:

Execution: Batches, orders, and executes L2 transactions.

More recently this module has been segmented further into sequencers and executors (more on this later).

Settlement: Finalizes L2 transactions & connects L2s with the base L1 and other L2s.

Consensus: Orders and finalizes L1 blocks.

Data availability (DA): Allows anyone to audit the blockchain by making the blockchain’s recent transaction history publicly available & easily accessible.

(This post is meant to focus primarily on value accrual - for more information on modular blockchain technology, mechanics, and terminology, please refer to my recommended references at the end.)

Benefits of a modular design

Admittedly, modular blockchains today add additional complexity and trust assumptions into the tech stack. So why are they worth all the trouble?

Data availability sampling, only possible in modular architectures, is *arguably* the only viable path to scale web3 infrastructure for mass adoption.

*I personally think both modular & monolithic designs will be viable for different use-cases & end-markets*

Shared modules (e.g. sequencer, DA) enable trust-minimized cross-chain interoperability & composability.

Modularity allows projects to bootstrap and experiment with new technology much cheaper and faster. Developers can focus on core-competencies and outsource all other functionality.

(The Celestia Thesis, by rain&coffee)

Which layers are the most valuable?

As I’ve mentioned, this space is still nascent and rapidly developing. Token utility, monetization mechanics, and value drivers are likely to evolve over time, so how can we think of future value accrual today? Given this uncertainty, I believe the best way to think of value per-module is transaction volume and product margins.

Module Value Accrual = Volume x Margin

Volume, or relative share of transaction data, can be estimated by positioning in the tech stack. In the example below, Celestia is the DA & consensus layer, which feeds to multiple settlement layers. Each settlement layer can also host different execution layers (rollups/app-chains). So, I believe it makes sense to broadly assume volume per module increases lower in the stack.

(The Modular World - Maven11 Research)

Margin represents the pricing premium that differentiated products can sustainably charge customers. Assets with network effects are harder to replace and therefore can charge a premium price. Others will commoditize and compete on price, minimizing long-term profit margins.

Module network effects

Sequencing: Shared sequencers (integrated with multiple roll-ups/execution modules) enable cross-rollup atomic composability and benefit from pooled security & decentralization.

Execution: I fail to see many network effects here; executor scalability is limited by state bloat. I imagine the largest rollups (with sequencers) in the future will offer free execution to achieve scale & monetize MEV instead. A similar dynamic occurred in retail equity trading: once brokerages started to sell order flow to large market makers, trade commissions were a race to zero in order to win volume share.

Settlement: Trust-minimized L1 asset bridging allows rollups to benefit from pooled liquidity, users, and native assets (this is why ETH remains so attractive to developers to build on).

Consensus: Rollups can pool and share security by using the same consensus layer.

Data availability: Sharing a single DA layer enables cross-rollup composability and pooled security.

For simplicity, I assume the network effects are equally valuable.

Module value accrual

Putting it all together, we can create a rough outline of value accrual across the modular stack. Given this framework, it’s my current view that consensus and DA will accrue the most value long-term, followed by settlement and then sequencing. Unless execution modules can develop network effects, I believe they will commoditize and accrue the least amount of value in the stack.

My motivation for this piece was to introduce a framework that outlines my initial thoughts on the relative value of different blockchain layers. If you are thinking through modular network effects or value accrual, please reach out!

References I found most helpful:

David, In thinking more about Celestia, and your write up on potential sustainable value extraction, is it as simple as applying an estimated extractable value for all of Celestia’s blocks at 70% full and projecting that into a future cash flows in order to get a discounted current day price target for TIA? Have you work on modeling anything like that yet, if not, I might see if I can set up a model and look at discounts and sensitivities. It feels like TIA is getting a little overvalued (on fundamentals) this month, but there is no accounting for the value this market places on speculation. Either way, I would like to start conceptualizing TIA’s value based on some reasonable assumptions so that I can determine how much comfort I have with picking up a larger position in my portfolio. Thanks, Christof

"I imagine the largest rollups (with sequencers) in the future will offer free execution to achieve scale & monetize MEV instead." Does it imply that you think future MEV revenue will be less than current fee revenue?