Impossible Cloud Network: Web3's Trojan Horse into Enterprise

Why ICNT is the market's best kept secret (for now)

(M31 Capital recently initiated a position in ICNT)

Web3 has no shortage of infrastructure projects. Every month, a new DePIN startup launches with a promise to disrupt AWS, only to flame out in the liminal space between crypto-native idealism and enterprise-grade expectations.

But what if the bridge already exists?

What if there’s a team that has already cracked the enterprise go-to-market motion, selling real, decentralized infrastructure to Fortune 500s, without relying on token subsidies, ponzinomics, or hype?

That team is Impossible Cloud (IC).

And the protocol powering it, Impossible Cloud Network (ICN), is quietly becoming one of the most credible Web3 challengers to Web2 cloud dominance.

A $7M+ ARR Trojan Horse

Most Web3 infra projects are still trying to find product-market fit. ICN already has it.

Impossible Cloud (IC), the centralized service layer built on top of ICN, has quickly surpassed $7 million in ARR with over 2,000 enterprise clients, including regulated players in finance, logistics, and media. It's fully S3-compatible, integrates with legacy tools like Acronis and Veritas out-of-the-box, and delivers performance that matches or beats traditional cloud providers.

During our diligence, founder Dr. Kai Wawrzinek shared that the go-to-market playbook mirrors his experience scaling Goodgame Studios to 500M+ users:

“Web3 has overinvested in infrastructure and underinvested in demand. We flipped that. We started with real-world sales and built backward.”

What makes IC different is that it's not just a customer of ICN, it’s its first proof-of-concept. And it pays 20% of its top-line revenue back into the protocol.

Web2 Usability, Web3 Guarantees

Most DePIN projects start with crypto-native users and hope to eventually serve enterprises.

ICN flips the script.

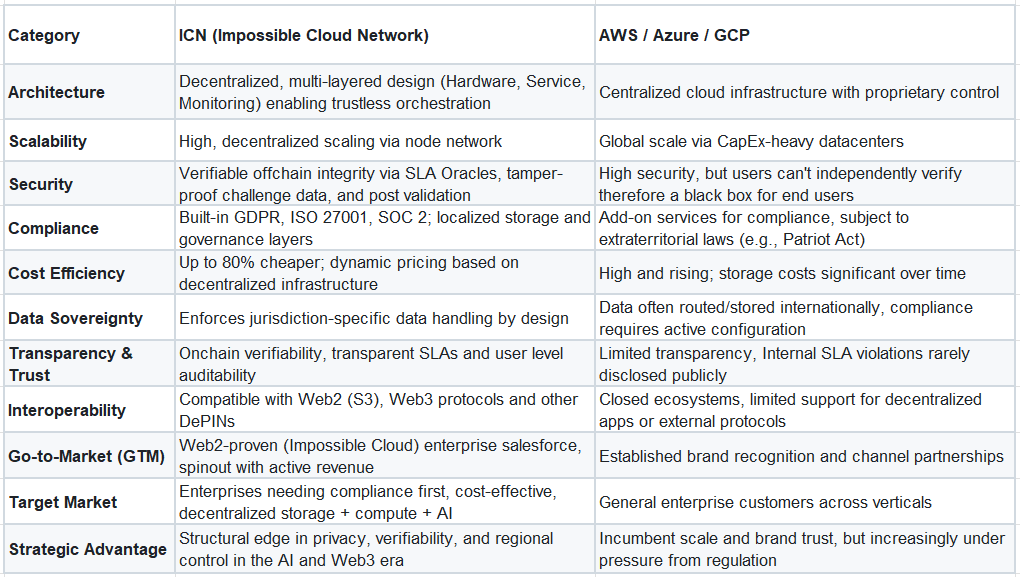

From day one, it was designed to meet real-world IT requirements: S3 compatibility, SOC 2 and ISO 27001 certifications, GDPR enforcement, and granular geofencing. “We can enforce that data never leaves a specific country or jurisdiction,” Kai explained, critical for clients in healthcare, finance, and government.

Under the hood, ICN’s service level guarantees are enforced by SLA oracle nodes that monitor infrastructure uptime and reliability. If nodes fail, they’re slashed. If they meet expectations, they’re rewarded. (full technical whitepaper)

It’s Web2 performance, with Web3 trust guarantees.

And it’s already live.

Channel Partners: Lifeblood of Enterprise IT

In enterprise IT, distribution is as critical as the product itself. No matter how powerful the infrastructure or elegant the software, it’s worthless if enterprises can’t easily buy, implement, and trust it. That’s why an estimated 64% to 90% of enterprise IT sales flow through indirect channels: resellers, systems integrators, VARs, and other partner-assisted models.

Impossible Cloud gets this in a way most Web3 projects don’t. While others obsess over tokenomics or developer ecosystems, Impossible is building like an enterprise-grade vendor, with a go-to-market strategy tailored for how real IT budgets are actually deployed.

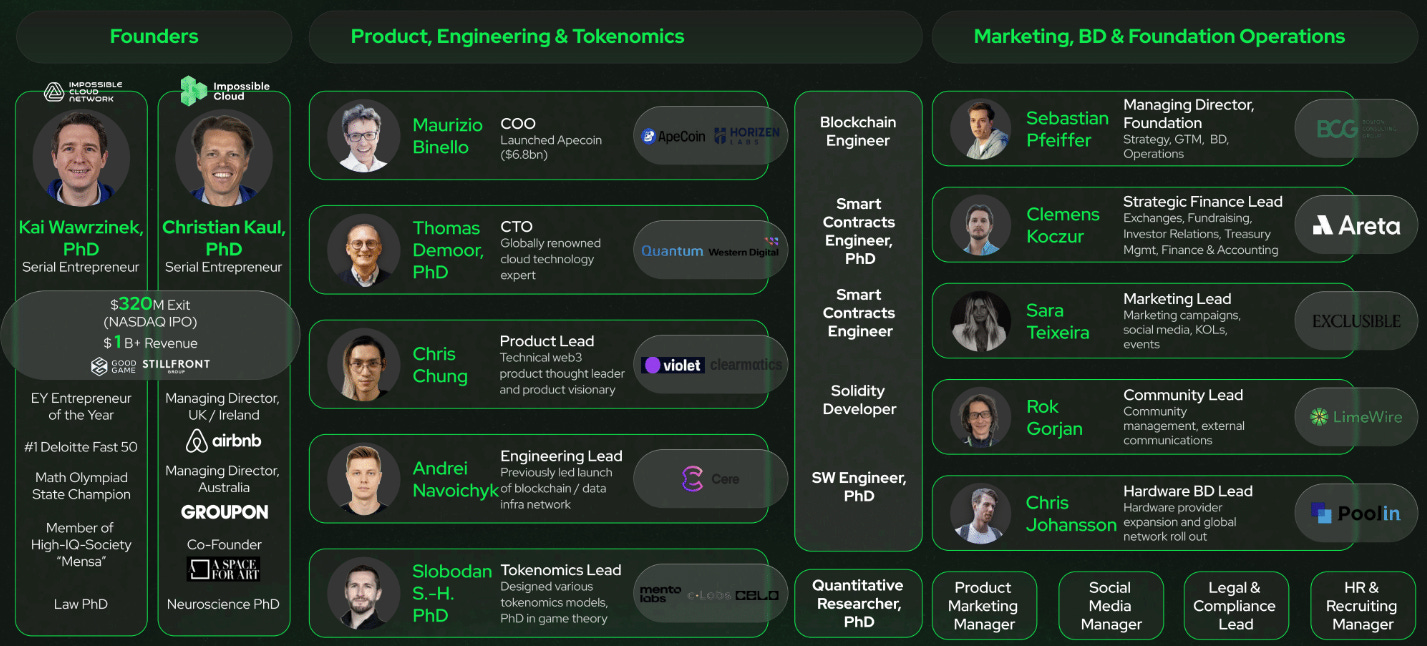

Led by veterans from Stillfront Group, Airbnb, Quantum, McKinsey, BCG, Groupon, Rocket Internet, and high-level M&A at General Atlantic and HG Capital, the team has decades of experience on the other side of the table. They’ve bought hundreds of millions in cloud services and know exactly what enterprise buyers need and how they buy it.

That insight has translated into execution:

1,800+ B2B customers onboarded through VARs and channel partners

Regional resellers across Germany, Benelux, the Nordics, and Southeast Europe

OEM and backup integrations with Veeam, Acronis, Veritas, Hornetsecurity, MSP360, and others

Planned expansion across the US and Asia, and other sovereign cloud markets

The result? Higher win rates. Faster time-to-revenue. Lower CAC. Especially in conservative, hard-to-reach verticals where trust and integration matter more than buzzwords.

As Clemens Koczur, CFO of the ICN Foundation, puts it:

“Most crypto founders underestimate how hard it is to sell to enterprises. We don’t. That’s our advantage.”

Impossible Cloud isn’t trying to reinvent enterprise sales; it’s riding the same distribution rails used by Cisco, Dell, and Microsoft. This sales-first mindset isn’t just smart. It’s rare. And it’s why Impossible could become the first Web3-native infrastructure company to truly break into the Fortune 500, not by disrupting from the outside, but by embedding within the channels that actually move product.

Token Flywheel & Equity Alignment

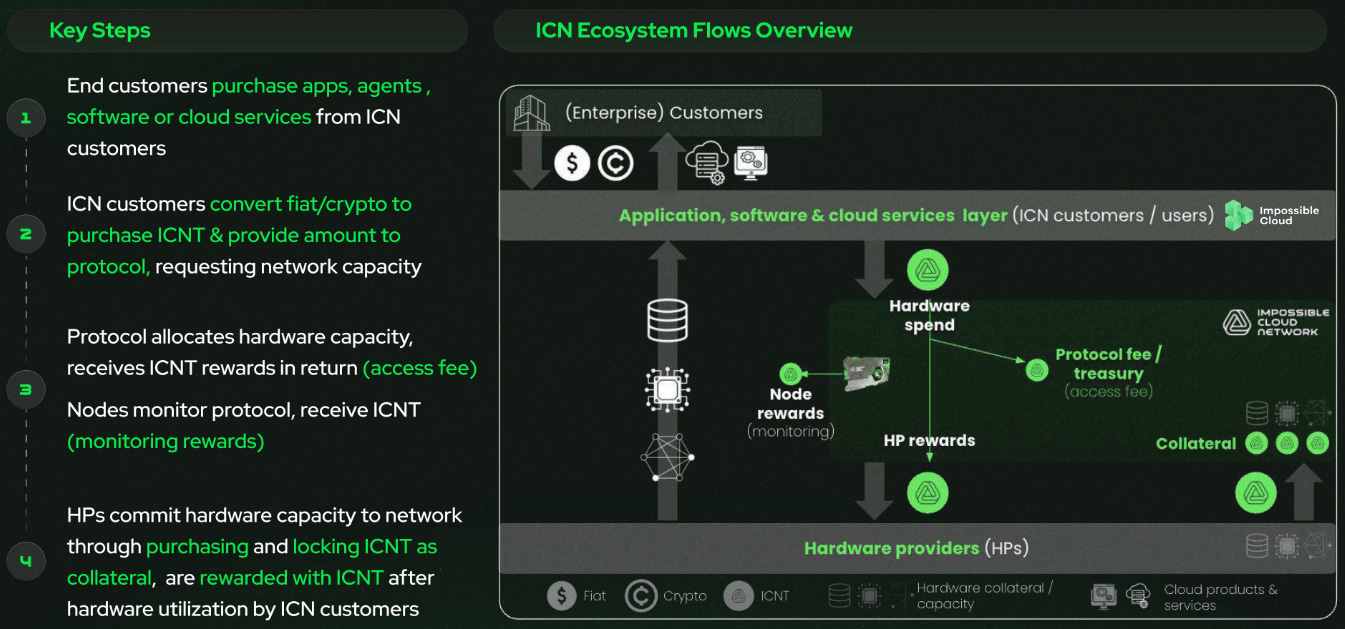

At the core of ICN’s design is a simple, powerful idea: real usage drives protocol value.

The ICNT token plays four key roles:

Access: Service Providers like IC must purchase ICNT to use the network.

Incentives: Hardware providers and SLA oracles earn ICNT for uptime and compliance.

Security: Staked ICNT is slashed for downtime or misbehavior.

Governance: ICNT holders vote on parameters, emissions, and roadmap.

The relationship between IC and ICN is often misunderstood, but crucial.

IC is the go-to-market engine, selling real services to real enterprises. ICN is the infrastructure layer, capturing and scaling that demand across a decentralized, cryptographically verifiable network. As Clemens put it, “Impossible Cloud is just one of hundreds of service providers that will eventually build on ICN.”

Kai echoed that sentiment:

“IC is the POC. The network is the product. That’s why I invested $3 million of my own money, just in the token.”

This clarity of structure (separate names, separate entities, shared incentives) is rare in crypto, and it shows. As Clemens described,

“We moved the backend of Impossible Cloud into ICN, and opened it up. It’s AWS Marketplace, reimagined as a decentralized B2B platform.”

Beyond Storage: A Full-Stack, $5 Trillion Opportunity

ICN isn’t just a decentralized storage network; it’s building toward a full-stack, sovereign cloud platform. The protocol is already expanding beyond object storage into high-value services like compute, GPU workloads, edge inference, and AI infrastructure.

The foundation is in place:

80+ petabytes already onboarded, with another 200+ PB in the pipeline

LOIs signed with compute and GPU providers across multiple regions

Partnership discussions underway with sovereign data center operators across the US and Asia

API and SDK launches scheduled for Q3 2025 to support developer integrations

As Kai put it:

“The model works. Former Filecoin miners, new GPU providers, even traditional data centers want to join. And they all want liquid incentives. Once the token goes live, we’ll enter hyperscaling mode.”

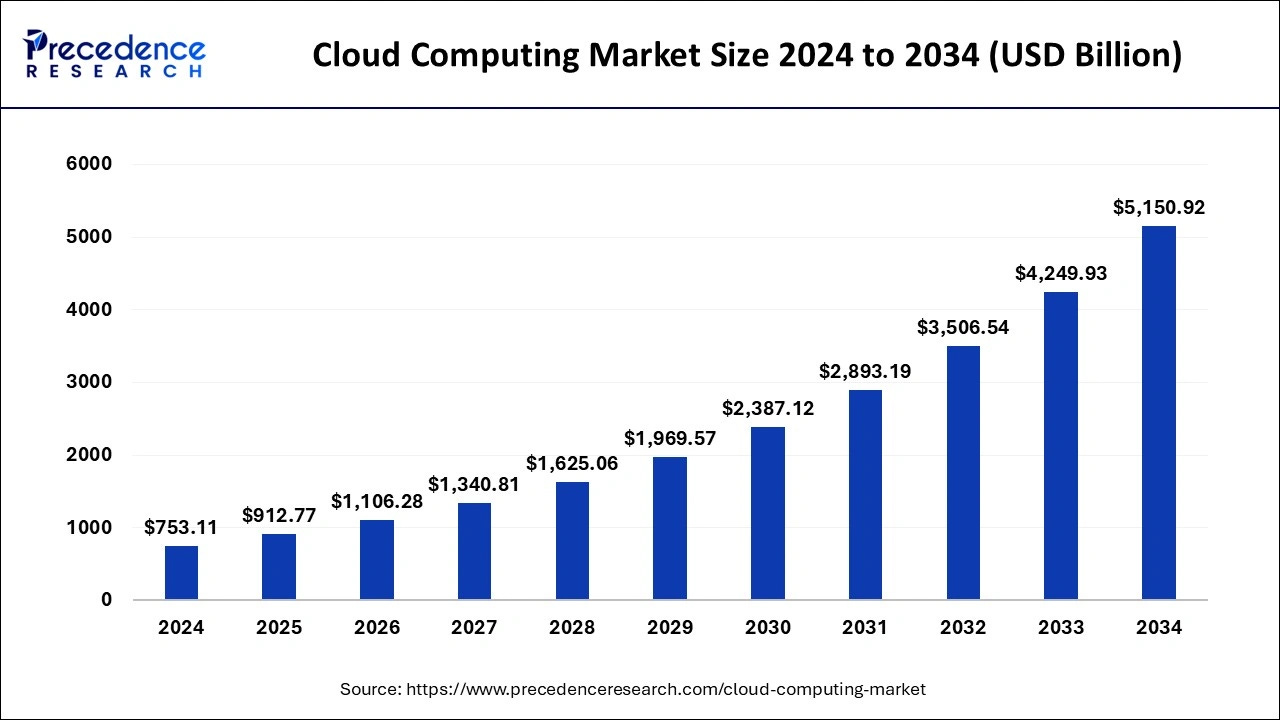

This push comes at exactly the right moment: the global cloud market is projected to exceed $5 trillion in the next decade, fueled by explosive demand for AI workloads and real-time data infrastructure.

But as the world becomes more data-sovereign and geopolitically fragmented, hyperscaler dominance, especially from U.S. firms, is starting to look like a liability.

That’s where ICN has a structural edge.

European enterprises and governments, in particular, are demanding sovereign alternatives. As ICN Foundation CFO Clemens Koczur noted:

“Even if your data is in Frankfurt, AWS is still subject to the Cloud Act.”

ICN meets these demands with:

Enforced data localization

Granular geofencing

No single point of failure

Verifiable infrastructure compliance

As AI continues to reshape how value is created, stored, and monetized, owning the infrastructure layer becomes a strategic advantage. ICN is positioning itself as the neutral, compliant, and scalable backend for this next era; one that’s not just Web3-native, but enterprise-ready.

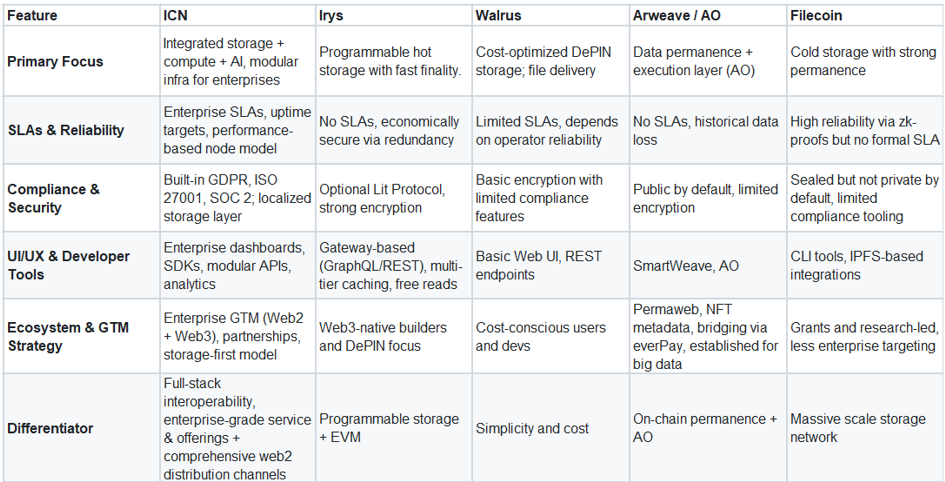

Web3 Cloud Landscape

In contrast to most Web3 DePIN projects, ICN emphasizes a broad ecosystem approach rather than vertical silos. Its comprehensive service suite enhances interoperability and serves a wider range of use cases, creating a network effect across industries. ICN recognizes that storage is a critical dependency for nearly all digital services, and by prioritizing it as the entry point, the protocol builds a solid foundation for adjacent offerings like compute, networking and AI. This bottom up strategy not only enables seamless integration of future services but also positions ICN to lead in a more versatile and composable Web3 infrastructure stack.

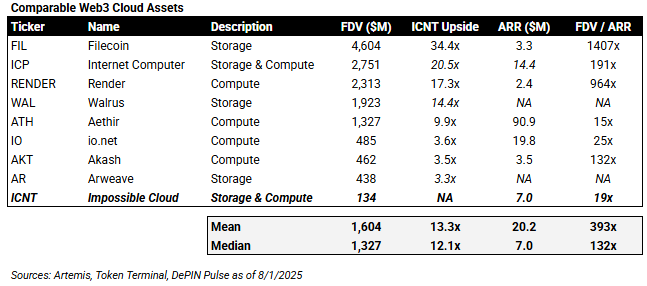

ICN’s comp group includes storage, compute and full-stack cloud providers. The average FDV across these projects is $1.6 billion, 13.3x ICNT’s current valuation. ICN already has higher ARR than many of its competitors, suggesting a highly asymmetric risk/reward.

Long-Term Upside Potential

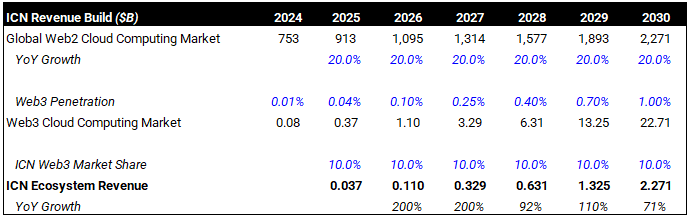

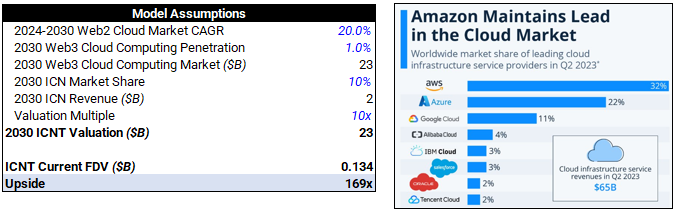

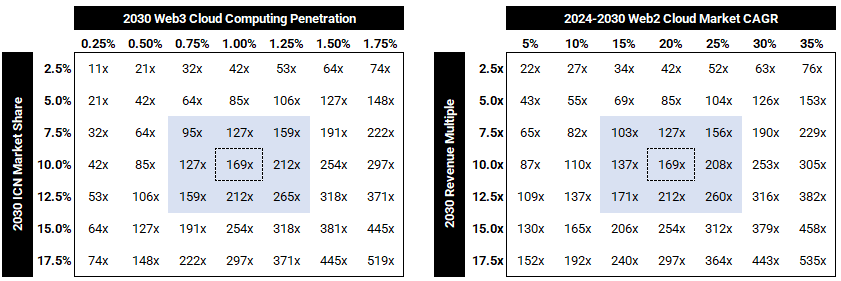

Precedence Research projects the global Web2 cloud computing market will grow 21.2% annually from 2024 to 2030, but for simplicity and conservatism we assume a 20% CAGR over that time period. Our upside scenario assumes Web3 penetrates 1% of the market by 2030, yielding a TAM of ~$23B.

Based on current Web2 market dynamics, if ICN sustains Web3 cloud leadership through 2030 (~10% market share), it could achieve significant scale. Applying a 10x multiple, which we believe is highly conservative given the implied revenue growth, ICN would be worth $23B, representing an attractive 169x upside (nice).

A Bet on Execution, Not Hype

If there’s one thing that stands out, it’s the team.

Co-Founder and CEO Kai Wawrzinek is a repeat founder with a $300M+ NASDAQ exit, having scaled a cloud-intensive gaming platform to 500M users.

Co-Founder and COO Christian Kaul led Airbnb UK/Ireland and was an early executive at Groupon (Rocket Internet backed).

CTO Dr. Thomas Demoor is one of the top object storage experts globally, with 20+ patents and a PhD in distributed file systems, and played an instrumental role at Western Digital’s $300M+ sale of its object storage business line to Quantum.

The Impossible Cloud Network foundation is led by Sebastian Pfeiffer (BCG), Maurizio Binello (Apecoin / Horizen Labs), and Clemens Koczur (Web3 and TradFi background).

These aren’t tourists. They’re operators. And they’re already delivering.

What Comes Next: Product & GTM

Mid Term Q3/4 2025

US Hardware Expansion: Strategic hyperscaling in the US with a dedicated lead focused on infrastructure partnerships, onboarding data centers and storage nodes.

SDK/API Release: Launch of developer tools to build on the ICN protocol.

2026 & Beyond - Full Stack Vision

ICN Marketplace Launch: Decentralized marketplace for cloud primitives, including object storage, bandwidth, compute and GPU provisioning. Aims to enable plug-and-play cloud infrastructure via smart contracts.

Compute & GPU Provisioning: Move beyond storage into compute services, including high-performance compute (HPC) and GPU for AI/ML training and inference workloads.

Global Hardware Network Expansion: Scaling across multiple continents, improving fault tolerance, geographic redundancy and enabling regionalized cloud zones for sovereignty and latency optimization.

Longer Term ICN Vision

AI Optimized Infrastructure: Creation of sovereign compute zones with dedicated low-latency GPU pools optimized for AI workloads: training, inference and LLM fine-tuning.

Decentralized CDN & Network Layer: Evolution into a full-stack decentralized cloud with integrated content delivery (CDN), edge compute nodes and bandwidth primitives.

Final Thoughts

Impossible Cloud isn’t trying to win over crypto Twitter. It’s trying to win over CIOs.

And it’s working.

With $7M+ in ARR, 2,000+ enterprise clients, real-world usage flowing into the token, and a clear roadmap to full-stack decentralized infrastructure, ICN isn’t just a bet on a new protocol - it’s a bet on an old-school, enterprise-grade execution engine, wrapped in a crypto-native flywheel.

It’s not just a protocol. It’s a Trojan horse.

And it’s already inside the gates.

Special thanks to Zak Harrow for contributing to this article