Quantifying the thesis: web3 (part 2)

how much value will accrue to each layer of the tech stack?

In my last report, I sized the potential web3 market in 2030 (link). My bull case assumptions implied a $5.6T revenue opportunity, and I believe that could value the industry at $56T.

Now for the interesting part: segmenting the web3 market opportunity by tech stack. For the sake of simplicity, I've divided the market into two broad categories: “applications” and “general purpose tech”. I then segment general purpose tech into three subcategories: consensus (L1), execution (L1/L2/L3, etc.), and infrastructure/middleware (everything else). Next, we must figure out how much market share each piece of the network is likely to capture.

Web3 revenue share

As illustrated below, web3 applications today typically generate earnings margins (revenue share) between 70-90%. This is in-line with typical software gross margins (link to comps) - and since web3 apps have lower overhead, their earnings margins should be pretty close to gross margins.

As blockchain technology progresses, and functionality improves through the development of next-gen middleware solutions (interoperability, security, privacy, KYC/AML, etc.), I believe applications margins will decrease slightly long-term to pay for the incremental utility. Therefore, I assume steady-state application margins will be 70%.

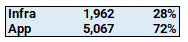

This assumption also aligns with web2 revenue share dynamics. Referring to the internet GDP model from my previous report (link), applications are projected to generate 72% of industry’s revenue in 2030.

(note: “Integrated Firms” are both infrastructure and applications)

The breakdown of revenue within general-purpose tech is less straightforward since blockspace (L1 consensus) is a novel asset (not comparable to web2). I believe blockspace can never become “commoditized” since blockchains all have unique characteristics (decentralization, security, finality, speed/throughput, atomic composability, etc.). Therefore I believe (premium) blockspace will be the most valuable general-purpose resource in the future and win the majority of the the category’s revenue share (67%).

I do think execution, on the other hand, will commoditize. As VanEck points out below, although L2 execution products on Ethereum currently demand margins between 15%-40%, they will likely shrink to 10% in the longer-run due to intense competition.

I agree with this view and assume execution will accrue 10% of the revenue of the consensus layer. The remaining 8% of the market will go to everything else (infrastructure/middleware).

Valuations multiples

I use 10x as the benchmark revenue multiple based on a decade of data from public cloud companies.

So how should each web3 category be valued? What are the factors that contribute to valuation multiples in the first place?

Valuation multiples are effectively short-handed DCFs; therefore they primarily depend on the following:

TAM (total addressable market)

Differentiation / moat (probability of success)

Utility

Using this framework, I believe the following are appropriate multiples across the web3 tech stack:

Applications: web3 apps have notoriously low moats given the open-source nature of the space.

Consensus: deserve a premium multiple given superior TAM, sustainable moat (unique blockspace), and greater utility (represents both network access + monetary share in economic activity).

Execution: benchmark multiple since large TAM cancels out low moat.

Infrastructure/Middleware: deserve slight premium given large TAM and above average utility (both access + economic upside).

Valuation implications

Applications: currently ~5,000 companies listed on the Nasdaq

Consensus: this is still a major question, but the industry likely settles on a handful of large consensus layers - I assume 10 to be conservative.

Execution: assume 25 execution options per consensus layer.

Infrastructure/Middleware: will likely be some consolidation in this space (easier to go to one provider vs. many), so I assume 15 infra/middleware winners per consensus layer.

Omnichain focus

Omnichain Capital exclusively invests in consensus and infrastructure/middleware projects, given their higher individual upsides. We believe these tokens have the premier risk/reward profiles in the market.

(Like most of my posts, my motivation is mainly to see where I could be wrong in my logic - not to try to convince anyone of anything)