Over the past decade, as the web3 tech stack has added more layers of technology & complexity, investors have debated where value accrues the most. Is it on the application layer (like web2) since utility ultimately creates value for the ecosystem? Or is it on the underlying blockchain that provides the critical infrastructure for the ecosystem to run on? I’ll explore both schools of thought, but ultimately, I don’t believe this is the correct framework to use.

Fat Protocol Thesis (FPT)

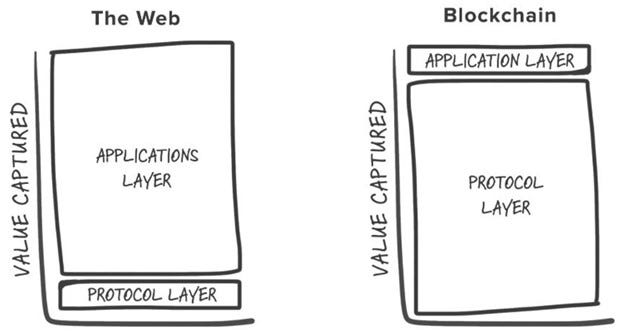

The conversation began with the fat protocol thesis (link), written in 2016 by Joel Monegro, which postulated that most value accrues to the bottom of the tech stack, or protocol layer. Unlike web2, Monegro theorized, web3 applications don’t have data monopolies because of the technology’s open-source nature.

by replicating and storing user data across an open and decentralized network rather than individual applications controlling access to disparate silos of information, we reduce the barriers to entry for new players and create a more vibrant and competitive ecosystem of products and services on top.

Open-source software has a multitude of benefits, including supercharging innovation, but it unfortunately also limits competitive moats at the application level. Therefore, Monegro concludes that most web3 value accrues to the blockchain (protocol layer) – the technology that applications all depend on.

FPT critics

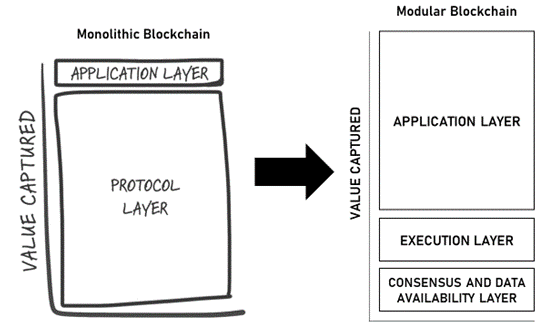

More recently, the FPT has been challenged by critics who believe the dynamic has changed dramatically with the introduction of L2 scaling solutions that sit between the protocol and application. Chia Jeng Yang (link) argues protocol value capture has eroded for several reasons, including applications deploying to multiple chains, L1 competition leading to fee compression, and scaling solutions diminishing overall demand for L1 blockspace.

Amidzic Momir (link) goes a step further to introduce the fat application thesis (FAT), arguing the introduction of rollups greatly reduces the cost of security & execution, leaving the bulk of value capture for the application layer.

Which side is right?

Personally, I don’t believe this is the correct framework to think about value capture. What does value capture even mean? Revenue? Margins? And what are we even comparing? An application vs. an entire blockchain? All applications vs. the blockchain?

I’ve previously argued utility tokens derive value from the demand to use the blockchain or application, (unless the application distributes real-world value to token holders) so revenue hardly tells the entire story, but usually can at least be used as a proxy.

Revenue capture

When discussing value capture, analysts seem to focus on transaction margins, or the percent of fees going to each layer. Let’s assume in the future users only directly pay application fees – gas fees (and other operating expenses) are then paid by the dApp.

Through this lens I agree with the FAT; per transaction, the application should get a higher percentage of fees than the blockchain. But I don’t believe this reveals a ton about value capture. Let’s say an application generates $100M in total revenue for the year. Using the example margins below, the application nets $40M in profit vs. $10M to the blockchain (or “security”; assumes modular design with separate execution).

So, the application accrues more value, right?

But the blockchain hosts 100 applications that each generate $100M in revenue, so the blockchain nets $1B in fees vs. each application netting $40M each.

So, the blockchain accrues more value?

But blockchains derive value from blockspace demand, not revenue (directly), so the analysis is inconclusive. Therefore, I don’t think either of these theses are great valuation frameworks.

Which leads me to my own thesis…

The Fat Paradox

Fatter applications actually increase the value of the underlying protocol!

If L1 network value is derived from blockchain GDP (total application revenue generated on top), then increasing protocol revenue margins is beneficial to the L1. The more developers can profit from deploying applications on a certain blockchain, the more demand there will be for that blockspace, increasing token value.

A blockchain is only as valuable as the economy it supports!

Beautifully written! More focus is needed in this area, as there is a broad misconception of what 'value' means not just in web3, but in general.. since our understood methods of valuating assets are perverted by Tradfi. It would benefit everyone to wipe their brains clean of any preconception of value when approaching this problem with this new paradigm and all the new tools available.