Why do tokens have value? (part 2)

middleware/L2: compute, storage, data management, scaling solutions

Part 1 recap:

In part 1 I explored layer 1 token valuations, arguing they should be derived from their blockchain’s utility, i.e. access to the ecosystem/economy. As such, I concluded that blockchain GDP (revenue produced by all dApps dependent on its security) is the best proxy of value for L1 tokens.

So, what about layer 2 tokens?

What is layer 2 middleware?

Blockchains are generally in charge of keeping an accessible record of all transactions, determining their sequencing, enforcing the global state, and executing smart contracts. They attempt to optimize for decentralization, security, and scalability, but typically can only solve for 2/3 (aka the blockchain trilemma), limiting the amount of compute, storage, and general functionality possible on-chain:

Because of these network design limitations, applications typically require middleware to supplement the underlying layer 1 technology, creating a more modular stack (e.g., using Ethereum for consensus & settlement, off-chain storage provider Arweave for data availability, off-chain GPU compute from Render Network, off-chain data from oracle Chainlink, and off-chain smart contract execution from Polygon). By leveraging middleware to enhance full-stack technological capabilities, developers can better solve for the blockchain trilemma and deliver higher quality applications to end-users.

There are many different types of middleware, but for simplicity I focus on four main categories: compute, storage, data management, and scaling solutions:

L2 middleware tokens work similarly to L1 tokens: to incentivize supply-side participation. As mentioned in part 1, for blockchains this comes in the form of miners/validators, who supply nodes to the network to create the product: blockspace. Users then need the L1 token to access the network, so its value is derived from blockchain utility. L2 middleware tokens are also used to incentivized supply-side participation, most notably off-chain compute/execution, storage, and data management. Users need L2 tokens to access these networks, so their value is derived from the middleware’s utility.

If blockchain GDP is a proxy of L1 token value, I believe middleware GDP (total dApp revenue dependent on its infrastructure) is the best proxy for L2 token value.

But what about blockchain/protocol revenue?

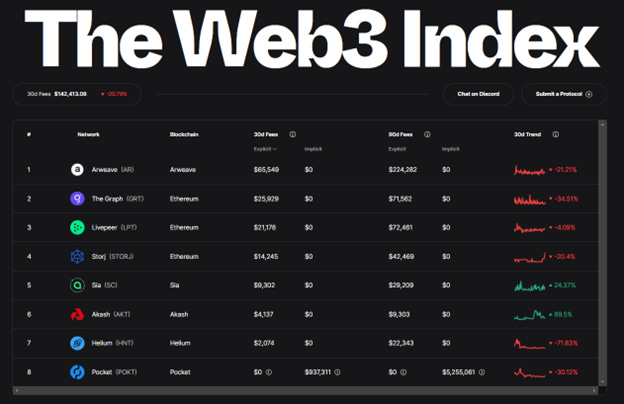

Many websites track “revenue” or fees paid to blockchains & protocols, such as The Web3 Index and Crypto Fees, while Token Terminal even computes network P/S (price/sales) valuation multiples:

Why network fees do not drive token value:

So why don’t I think fees are “revenue” for token holders and a proxy for token value? I recently went on a twitter rant explaining my position:

To recap my logic:

Fees for L1 or L2 networks are taxes to fund network operations (pay the supply-side)

The supply-side gets paid for their service: contributing mining/validating, nodes, compute/storage, data management, scaling, etc.

But receiving X tokens doesn’t give the asset or token value

Why is this compensation worth anything in the first place? Because the supply-side receives it for their service? One can see how the logic is circular…

Actual token value is derived from its utility: access to its specific network

What is this access worth? The value of participating in the network should be derived from economic activity enabled by it (middleware GDP; total revenue generated by dApps leveraging the L2 network).

“Protocol revenue" = operating expense

Fees are more akin to network COGS / operating expenses, as illustrated in the table below:

L1 vs. L2 valuation multiples

All else equal, I believe layers lower in the tech stack are stickier, i.e., it’s generally harder for a dApp to move blockchains than it is to switch middleware providers. There are many Ethereum scaling solutions in the market today but only one Ethereum blockchain. While compute/storage primitives are ultimately commodities (processing power, storage capacity), blockspace is not: its value depends on the chain’s unique network effects, security, decentralization, etc.

So, are middleware providers destined for commoditization then?

I don’t think so. Like L1 blockchains, middleware networks combine compute/storage with unique network effects (from composability), security, and decentralization characteristics. Additionally, middleware hosts operating software on top of its infrastructure, enabling protocols to sustain differentiation over time. Nonetheless, I do think middleware will be relatively easier to replace in the tech stack, and therefore L1 tokens should command higher GDP valuation multiples than L2s.

L3 valuations:

Part 3 will be the final segment of this series and it will explore why layer 3 application tokens have value (hint: they don’t….yet!).

Disclosure: we have positions in ETH, AKT, CUDOS, RNDR, ANKR, GRT, LINK, AR, MATIC

Photo credit: bookstr.com