Why do tokens have value?

part 1: blockchain/L1 tokens

Securities are a claim on equity/assets and derive their value from future cash flow.

Commodities are goods & resources that derive their value from demand for their utility.

So – what about blockchain (layer 1) tokens? What are they used for and why do they have value?

Tokens asset classification has been an ongoing debate between the SEC, CFTC, and Congress for much of the past decade. Although it’s still TBD, we can explore the role tokens play for layer 1 blockchains to better understand how they derive value.

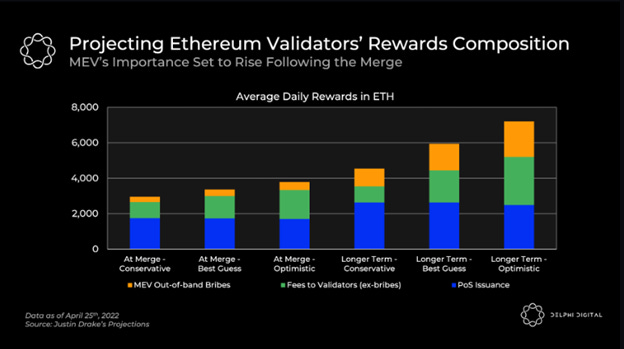

Tokenomics vary across blockchains, but for the typical PoS blockchain, the native token is required for transaction fees which are then distributed to stakers or used to burn tokens. Stakers also typically receive inflationary token rewards and a share of MEV revenue (“bribes” that arbitrageurs pay validators to optimize speed on time-sensitive trading opportunities). The chart below illustrates the possible mix of ETH validator compensation at and post-merge.

Real staking yield = staking rewards (some combo of transaction fees, inflation, MEV) minus token inflation. Net token value capture (which calculates yield for all token holders, not just stakers) for leading L1s (below) suggests nominal to negative actual token “yields.” I put yields in quotes because holders receive this value in the underlying token. Just because I get 3% yield on my monopoly money doesn’t make it value generating. Why does the monopoly money have value in the first place?

L1 native tokens are used to incentivize staking (in a PoS model), which increases network security and decentralization. But this is not how tokens derive value – value is derived from the demand to use the blockchain (i.e., you need ETH to use any application on Ethereum).

How do you put a numerical value on “network demand?” I think the best mental model is to think of blockchains as sovereign countries with native tokens as currencies. The twitter thread below by crypto researcher Tascha does an excellent job diving deeper into the theory, and I highly recommend for further detail on the subject.

Ok, then how are currencies valued? Currencies don’t have absolute valuations per-se, instead they are valued in relation to other currencies. More demand for USD vs. JPY increases the value of USD vs. JPY. So, what influences demand for one currency over another? The main driver is economic opportunity. Therefore, I believe the most relevant metrics for L1 token valuation are TVL and blockchain “GDP,” or cumulative revenue generated by dApps that rely on the chain’s security.

While there is some value in tracking early blockchain traction (users, transactions, volume, TVL, GDP), it’s important to keep in mind use-cases are limited today and therefore current metrics are not a great indicator of future success. Looking at TVL market share since 2021, blockchains besides Ethereum have mostly failed to establish sustained success.

(defillama.com; detailed breakdown by L1 below)

Ethereum competitors spent the past year and half launching platforms with fast, low-fee transactions, while also offering users VC-funded incentives to use their blockchains. These programs have proven to be mostly ineffective, as TVL growth has mainly been driven by mercenary capital going chain-to-chain extracting incentives then moving on. These short-term metric bumps may work for trading in and out of ecosystems, but for long-term investors, the focus should be on potential utility and economic sustainability.

Venture investments, like crypto, should be valued based on future potential; blockchain TVL/GDP today is less relevant than what it could be over the next decade. Therefore, the best way to value tokens today is to model TVL/GDP for the next 5-10 years, discounting the result by probability of success. The goal isn’t to be precise but to be directionally accurate. A few blockchain characteristics to consider when modeling these metrics:

Network capacity (blockchain scalability): What is the maximum amount of economic activity (transaction throughput) that can be hosted on the blockchain? This calculation should include the use of L2 scaling solutions since they ultimately leverage security from the underlying L1.

Use-cases (tech/design differentiation): Different blockchains optimize for different characteristics (throughput, decentralization, security, speed, customization, etc.) which will attract different use-cases. Based on a chain’s specific network design – what use-cases are most likely to onboard and how big can that market ultimately be?

Sustainability (transaction fee / inflation schedule): Chains pay for security through fees and inflation. High fees and inflation recruit more validators (higher compensation) but dissuade users and token holders. Since chains must recruit both validators and users/dApps to support the ecosystem, the long-term sustainability of an L1 depends on the balance of its economic design.

Layer 1 blockchain tokens have characteristics of both commodities and securities: they have utility, but owners can also participate in the upside of the ecosystem. Regardless of their classification, they should be evaluated like venture capital investments – the focus should be on long-term ecosystem potential and probability of success.

Disclosure: we have positions in ETH, SOL, AVAX

Photo cred: Alec Monopoly