Chainlink's endgame: beyond data feeds

the platform is quietly becoming the one-stop-shop for all web3 middleware services

Most know Chainlink as the industry’s largest data oracle — a network of nodes that connect real-world data (event outcomes, real-time asset prices, weather, etc.) to dApps in a trustless, decentralized manner. After all, web3’s value and relevance depends on its ability to integrate with the physical world.

Its services are crucial to DeFi, insurance, NFTs, gaming, and more, powering >1,500 web3 projects today.

The bigger picture

What most don’t appreciate is — the network is barely scratching the surface. The same infrastructure that Chainlink uses to connect dApps to off-chain data can be used for basically any middleware service that developers need to create and run high-value dApps at scale. This includes web2/enterprises looking to improve operations and/or product offerings by leveraging web3.

Middleware stack

I’ve previously written about the limitations of blockchains and the need for middleware solutions (link):

Because of these network design limitations, applications typically require middleware to supplement the underlying layer 1 technology, creating a more modular stack (e.g., using Ethereum for consensus & settlement, off-chain storage provider Arweave for data availability, off-chain GPU compute from Render Network, off-chain data from oracle Chainlink, and off-chain smart contract execution from Polygon). By leveraging middleware to enhance full-stack technological capabilities, developers can better solve for the blockchain trilemma and deliver higher quality applications to end-users.

Instead of using different providers for each component, Chainlink aspires to become the one-stop-shop for developers (both crypto-native and non) to access the entire decentralized middleware stack, regardless of blockchain.

The following services have been recently announced/launched and will supplement the network’s main data oracle functions:

Proof of reserve

Monitors reserve assets using automated audits based on cryptographic truth.

Cross-chain communication

The industry has yet to solve for cross-chain interoperability: 69% of hacks this year ($2B) have been on bridges between chains. Chainlink believes it has a solution through its Cross-Chain Interoperability Protocol (CCIP), which provides a universal, open standard for developers to build secure services and applications that can send messages, transfer tokens, and initiate actions across multiple networks.

Off-chain computation

Near-term, Chainlink will offer basic compute functionality, such as automated DeFi trading, liquidity position management, rewards distribution, dynamic NFTs, and gaming.

However, after speaking with several Chainlink Labs developers, I believe longer-term the network will offer more powerful general compute & storage services, enabling dApps to migrate from centralized cloud infrastructure to a fully decentralized architecture. It could even become a distribution partner for incumbents (Filecoin, Arweave, Akash, etc.).

Privacy

Chainlink’s DECO network allows data to remain private off-chain while proving the state of the data on-chain, enabling privacy-preserving computational environments. One of the first big use-cases is private digital identity (you probably don’t want all of your personal income and expenditure information open to the public).

Fair sequencing

Initially the product will be applied to limiting Miner Extractable Value (MEV), or excess value captured by miners (or validators) from users in a cryptocurrency network. This excess value often comes from reordering users transactions to maximize fees or inserting new transactions that allow a miner to front-run users' transactions.

Enterprise adoption

Enables non-crypto-native organizations to securely and easily connect their existing systems to all major blockchain networks.

Where is Chainlink today?

Transaction Value Enabled (TVE) represents the total economic activity dependent on the platform, a good proxy for the network’s value. Chainlink enabled >$500B in transaction value in August 2022 and >$6T YTD.

Growing the pie

In order to maximize TVE, Chainlink is focused on growing the industry as a whole. Its recently announced BUILD and SCALE programs will help developers launch & grow dApps faster and more efficiently by creating more flexible payment options and reducing blockchain infrastructure costs. Middleware, like Chainlink, is only as valuable as the economy it supports!

Putting it all together: what’s the opportunity?

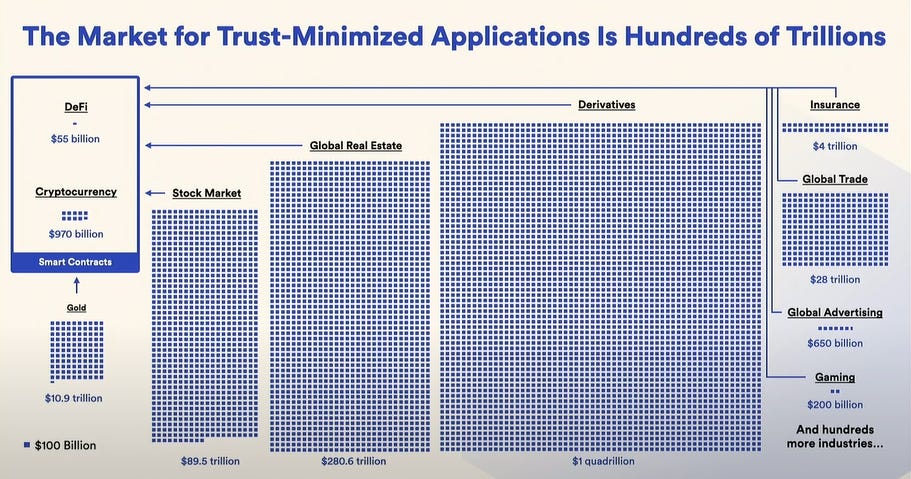

Chainlink’s endgame is to become the de-facto platform that connects all blockchains with the real world, for everyone from web3 startups to century-old enterprises. Its evolving product portfolio is creating the infrastructure needed to transition all of the world’s value into blockchain format.

The World Economic Forum and Boston Consulting Group predict $867T of value will be disrupted by web3 just in capital markets alone.

Using this forecast, Chainlink believes their market opportunity is $86B-$171B. Assuming it keeps its current 60% market share, this implies a $50B-$100B of revenue for Chainlink. (again, just for capital markets — Chainlink services all industries)

Using a 10x multiple (reasonable for high margin, high growth revenue) its not a stretch to believe Chainlink can become a $1T network in the future (140x vs. its $7B FDV today).

Its not too late to start paying attention to Chainlink’s ambitious end-game vision.

Disclosure: we have a position in LINK