Streaming legos: the Livepeer thesis

how composable video streaming can disrupt the media industry

Disclosure: Omnichain Capital has a position in LPT.

Earlier this year, I published “Compute legos” (link), which explored the novel capabilities that composable general-purpose compute could power. I then focused my attention on composable machine learning, or “AI legos”, the vision behind the Bittensor ($TAO) network (link). The following post will introduce the concept of “Streaming legos”, or composable streaming media, and why I believe Livepeer ($LPT) is building the backbone for the next generation of video applications.

Before we jump into the protocol, let’s explore the web2 streaming industry today and how permissionless composability could significantly open up the developer design space for media applications.

Web2 video streaming market

We all use video streaming technology everyday: TikTok, Instagram, FaceTime, Zoom, Netflix, and even live sports & news apps. Internet traffic has grown ~3x since 2016 and video-based traffic has risen from 73% to 82% of the total. Video streaming is in an exponential growth phase and has clearly cemented itself as the preferred medium for communications and entertainment.

Unsurprisingly, the video streaming industry is already a massive global market today, generating $89B in revenue last year. Research and Markets estimates the market will grow to $417B by 2030 (link), a 21.5% CAGR, driven by the explosion in streaming content, persistence of hybrid work environments, improved bandwidth technology, and continued global penetration of mobile devices.

Streaming networking infrastructure

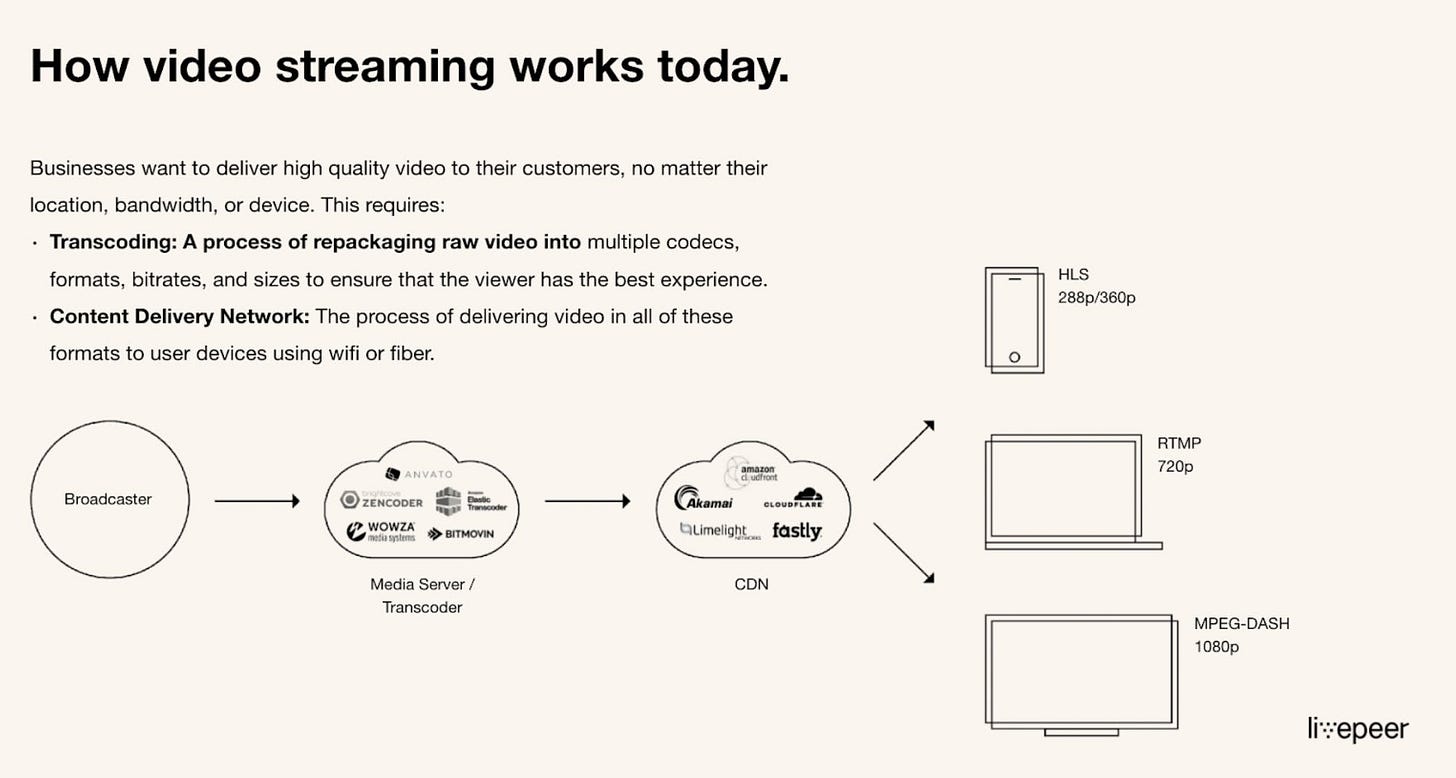

It may seem pretty straightforward, but video streaming (either live or on-demand) requires specialized infrastructure to deliver a quality viewing experience.

Transcoding: Optimizes video data formatting so it can be consumed in the best quality for any end-user device (phone, laptop, smart TV, etc.).

Content delivery networks (CDNs): Optimizes video data delivery routes to minimize latency (buffering).

Streaming legos

Now that we’ve established how video streaming works today, we can explore the possibilities of “streaming legos”, or composable streaming media. It’s another abstract idea (like composable compute and composable AI) with upside that is difficult to articulate today. However, I think an interesting web2 analogy/case study is the rise of CPaaS (Communication Platform-as-a-Service) over the past 10 years.

Similarities to CPaaS

In a previous life, I spent a decade in TradFi covering web2 networking infrastructure companies, on both the sell and buy-side. One of the most meaningful innovations during that time was the rise of CPaaS solutions, which allow developers to easily integrate audio, video, chat, and messaging functionality into business operations without having to build back-end infrastructure and interfaces. In other words, rather than using applications specifically created for communications purposes (such as Microsoft Teams or Zoom), CPaaS allows these features (live chat, SMS, voice or video calling) to be integrated into business applications with other primary functions.

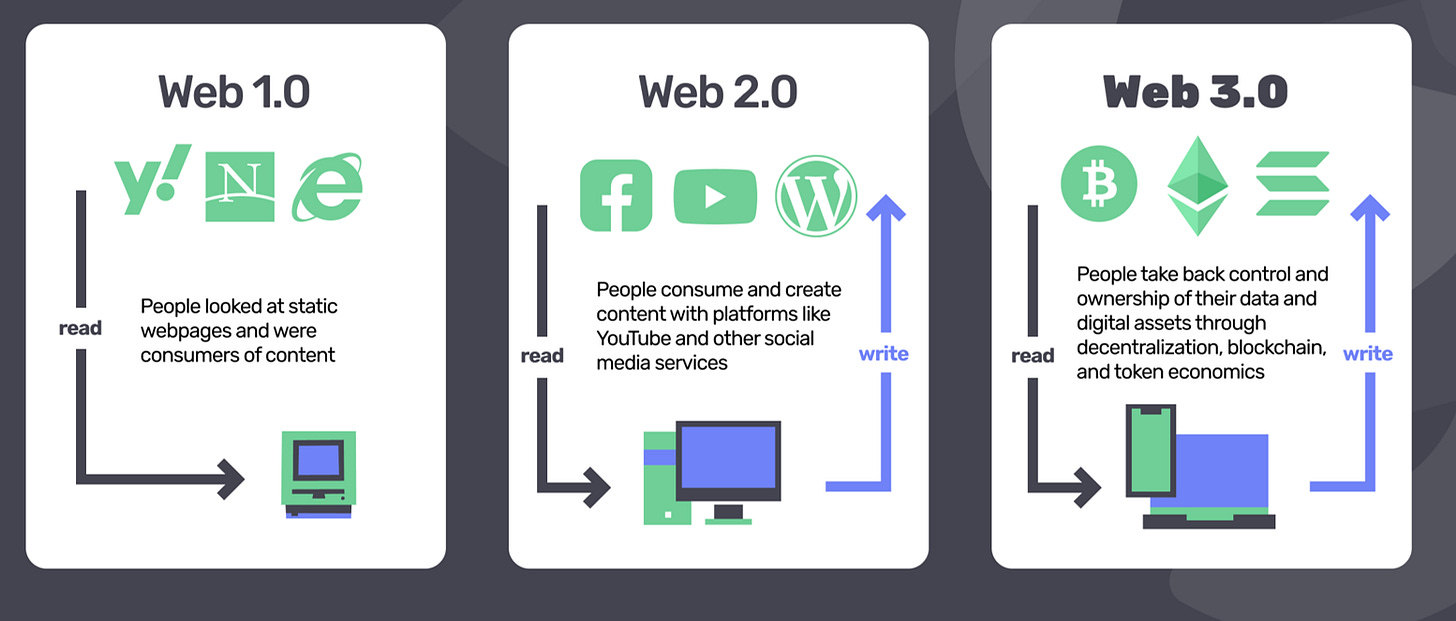

Many categorize “web2” as the shift from a static to an interactive internet experience, and behind the scenes, CPaaS played a large role in this evolution.

Twilio, the CPaaS industry leader, famously enabled the first (privacy preserving) text and call functionality for the Uber app in the early 2010s. While seemingly trivial, this functionality was extremely valuable at the time and actually incredibly hard to implement given all the complexities and nuances of cellular network back-ends. CPaaS quietly enabled much more meaningful user interactions within websites, apps, and enterprise software platforms. Its APIs enabled composability, which materially opened up the design space for developers.

Examples of incremental utility powered by CPaaS:

(fonada.com)

The success of the technology is evident in the CPaaS market’s meteoric rise, which grew from irrelevance in the mid 2010s to $13B today. Looking forward, Mordor Intelligence expects the market to grow to $47B by 2028, a 30% CAGR (link). Furthermore, Gartner predicts 95% of global enterprises will utilize API-enabled CPaaS offerings to uplevel their digital competitiveness by 2025 (link).

Ok now back to web3 and Livepeer…

Streaming legos: permissionless composability

The introduction of CPaaS meaningfully opened up the web2 developer design space and I believe streaming legos will similarly turbocharge web3 app functionality. However, unlike CPaaS and web2, streaming legos are permissionless. This allows anyone to experiment on top of platforms like Livepeer, speeding up innovation and pushing the limit on what’s possible.

So, what is possible? A few early ideas:

Video NFTs: Both on-demand video (shows and movies) and live broadcasts can be packaged as NFTs and even resold on the open market.

Could create the next Netflix…but without any of the heavy cloud computing and CDN overhead (greatly lowers barriers to entry).

New business models like metered media consumption are now viable (usage-based business model instead of flat subscriptions).

Social Media: Video has become the dominant medium on social media, but it will require a permissionless backend (like Livepeer) to facilitate web3 experimentation.

Friend.Tech gained traction from token-gated group chats…a similar concept could be applied to livestreams.

Gaming/metaverse: Add livestream functionality into any web3 game (think opensource Twitch). Can even stream video from within the metaverse (from the player’s actual perspective).

Novel Use-Cases: Like all web3 innovations, the most exciting use-cases will likely be the ones we can’t even imagine today:

I think one thing that's clear to me is that these killer web3 social apps are not just going to be clones of the social media apps we use today. It's not just going to be Twitter but built on web3 tech or Instagram but built on web3 tech. I think it's going to make use of the killer disruptive primitives that blockchains have enabled so far which have really been like instant global crowdfunding, you know permissionless global open financial system, digital asset ownership, collective coordination. Yeah ICOs, DeFi, NFTs & DAOs essentially. I think the killer web3 social apps are going to leverage and include these tools within exciting social and media-based products.

-Doug Petkanics, Livepeer Co-Founder

Livepeer overview

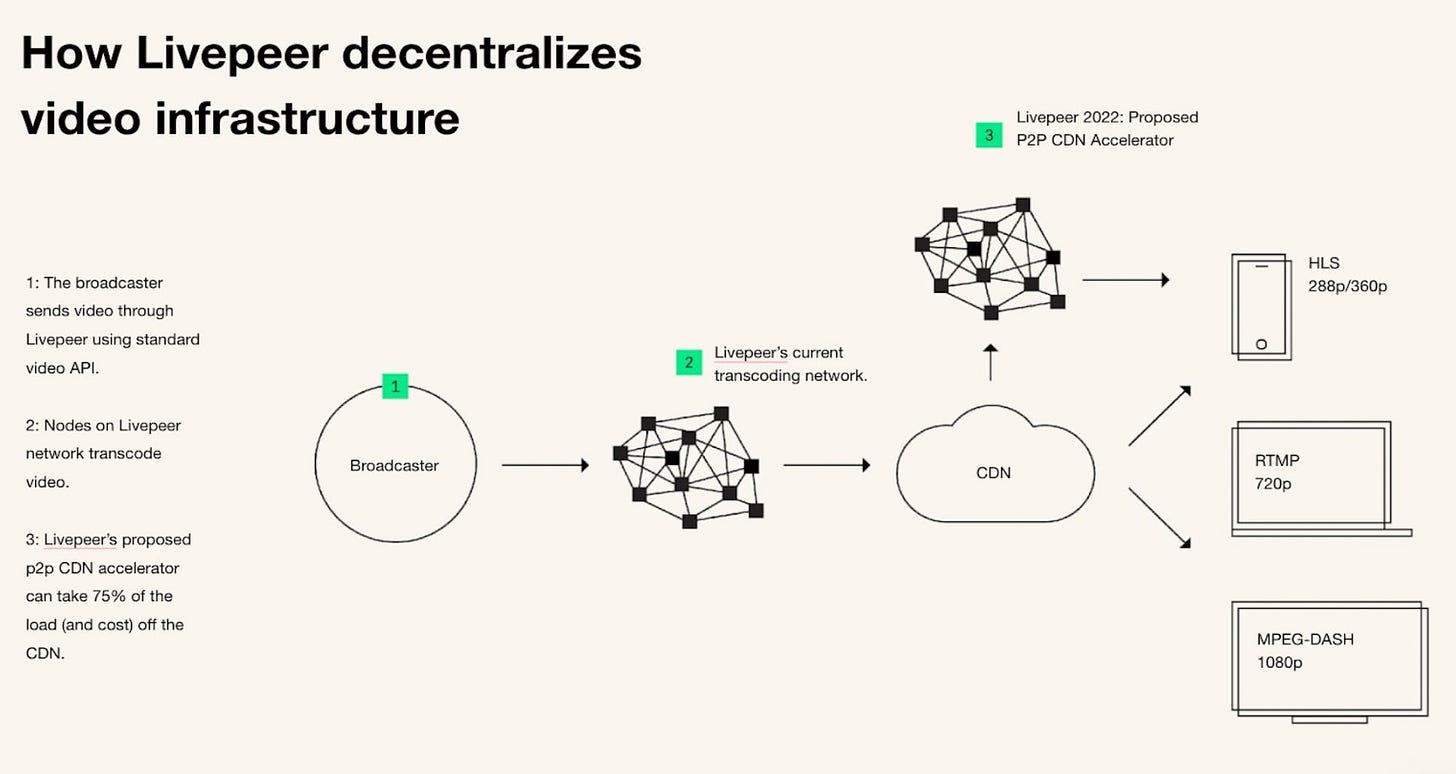

Livepeer was co-founded by Doug Petkanics (CEO) and Eric Tang (CTO) in 2017. The network essentially acts as a marketplace between infrastructure providers and streaming applications or app developers that require video processing services. The protocol incentivizes supply-side GPU compute contribution (infrastructure providers) through LPT inflation rewards & network service fees. Initially launched as just a video transcoding service, the protocol has since expanded to CDN solutions as well, currently offering a federated model (aka content delivery is outsourced to a group of CDNs, minimizing trust & points of failure). However, Livepeer is currently exploring different designs to eventually offer native P2P CDN functionality within the protocol.

This post is meant to outline Livepeer’s long-term opportunity vs. deep diving into the network tech & architecture. For more detail on how the platform works, Livepeer has a great “10-minute primer” on its website (link) which explains protocol mechanics in layman terms with easy-to-digest illustrations.

Livepeer today

Similar to other P2P web3 protocols, Livepeer’s networking overhead is limited (resources used much more efficiently), so services can be offered at much lower prices than centralized solutions. In fact, Livepeer believes its protocol is 10x cheaper than existing services for individual streams. Still, crossing the proverbial chasm into web2 / legacy broadcasters has proven difficult, and so far, adoption has primarily been limited to crypto-native developers.

Usage to-date has been steady but still minimal:

Although the protocol is still early, it has seen encouraging enthusiasm and experimentation from web3 developers looking to disrupt the traditional media industry:

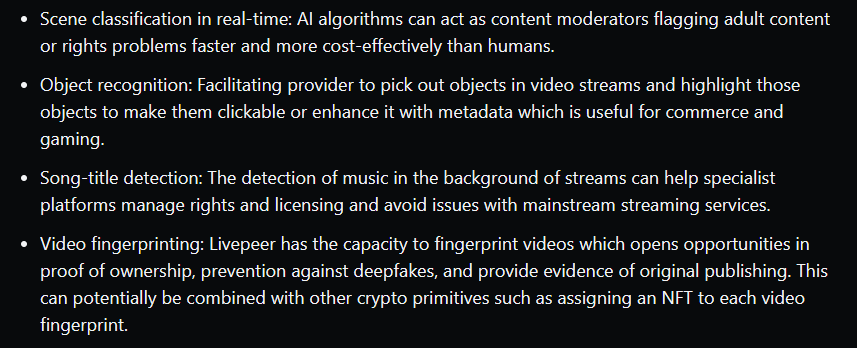

Interestingly, since supply-side nodes provide the network with general-purpose GPU compute, the protocol is contemplating additional future functionality, such as:

(Messari)

LPT upside potential

I use a cash flow valuation framework for LPT, since anyone can stake their tokens to participate in the network’s revenue share.

Within the $89B video streaming market mentioned earlier, infrastructure generated $23B in 2022, representing a more accurate TAM for Livepeer. Research Nestor expects this segment of the market to grow at a 16% CAGR through 2033 (link). Below I’ve modeled my bull scenario for Livepeer, which assumes web3 penetration of 20% by 2030.

Looking at mobile app CDN market leadership today, CloudFront (Amazon) leads with 40% share. Why does it win? CloudFront integrates with other AWS products, offering developers an easy way to distribute content to end users. Livepeer similarly aims to offer the entire web3 video streaming stack, so I think 40% market share is appropriate for my bull case.

(PacketZoom)

Token holders can stake (delegate) their LPT to network nodes (orchestrators) to participate in the network’s revenue share model. Orchestrators offer delegators ~50% fee share today, but this figure may increase or decrease longer-term. For simplicity, I assume it stays the same through 2030.

Although Livepeer does have token inflation to incentivize the supply-side, stakers receive dilution protection (i.e., their percent ownership of the network remains constant). Therefore, I keep token supply constant for my returns analysis (i.e., from the perspective of a staker).

These assumptions yield a $60B market cap by 2030, or $2,072 per token, up 374x from today! A seemingly reasonable upside considering Twilio’s ATH market cap was $75B in 2021.

Why use a 20x cash flow multiple? The 10-year average revenue multiple for public cloud computing companies is 10x, implying a 50x cash flow multiple (assuming 20% cash flow margins). Therefore, I believe 20x is sufficiently conservative.

(Bessemer Venture Partners)

Even using less bullish assumptions, long-term returns still look very attractive.

Composability increases developer design space, while permissionlessness accelerates innovation. This deadly combo drives much of my thesis on why web3 networking architecture will ultimately win.

Internet traffic has become overwhelmingly video, so for web3 to be successful, it will need decentralized transcoding and CDN infrastructure to deliver quality viewer experiences that are also composable and permissionless. I believe Livepeer is best positioned today to win this highly valuable market segment long-term.

Great post!